Deciding Should I Buy a Car Before or After I Move? can feel tricky, especially when you’re just starting. You might be juggling moving costs, a new place, and a whole new routine. This decision affects your budget, your daily travels, and even your peace of mind. But don’t worry! We’ll explore the best route for you, breaking down all the factors in a simple, step-by-step way. What comes next will give you the knowledge you need to make the right choice.

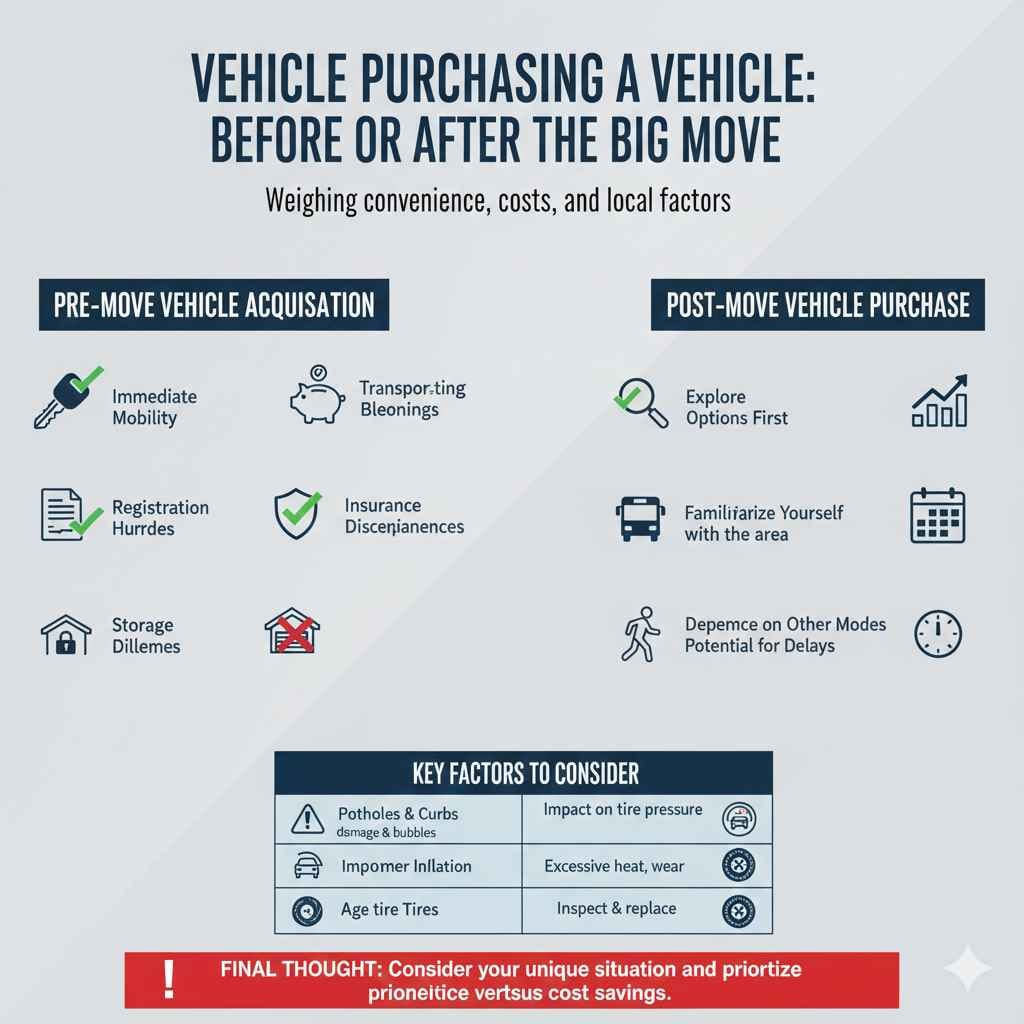

Vehicle Purchasing Timing: Before or After the Big Move

The timing of your vehicle purchase is a big deal when you’re moving. It involves different considerations that will affect your experience. It’s about weighing your needs against potential obstacles. Think about how often you will be driving and how far. Do you plan to move to a busy city or a quieter town? You’ll also want to review your budget and weigh all of the options to make an informed choice.

Pre-Move Vehicle Acquisition: Pros and Cons

Buying a car before you move has its ups and downs. One major plus is the convenience of having a vehicle from day one in your new place. This is especially great if public transport is limited or if you need to transport belongings. On the other hand, you might face complications like registering the car in a new state or insurance issues. Then there’s the possibility of added storage costs. Each factor must be evaluated before moving.

Immediate Mobility: Having a vehicle ready to go lets you explore your new area right away. You can go shopping, discover your neighborhood, and not rely on public transport or ride-sharing services from the start.

Transporting Belongings: If you’re moving your things yourself, owning a vehicle could be very helpful. You can move small furniture pieces, boxes, and other items from your old home to your new place without needing to rent a truck or hire movers.

Financing Options: You may find better car loan options in your current state. The rules and interest rates can vary greatly between states. This may allow you to purchase a vehicle with terms that better suit your financial situation.

Registration Hurdles: Registering a vehicle in a new state can be tricky. Each state has its own requirements, fees, and paperwork. This process can take time, possibly leaving you without a car legally for a while.

Insurance Discrepancies: Insurance rates change between locations. You could find that your auto insurance costs go up in your new area, causing unexpected financial strains.

Storage Dilemmas: Storing a vehicle until you move can bring on extra costs. If you cannot park it at the new place, you may need to find a storage unit. This can increase your moving budget.

Post-Move Vehicle Purchase: Advantages and Disadvantages

Buying a vehicle after you’ve relocated lets you assess local conditions before making a purchase. You can test public transportation, examine traffic patterns, and figure out the best type of vehicle for your lifestyle. Yet, you may be caught without transport in the meantime, which could cause a lack of flexibility. You will have to use alternative transport options until you have purchased a vehicle.

Explore Options First: Once you arrive, you can explore public transport, bike lanes, and local traffic before deciding what type of vehicle suits you. This helps to prevent buying the wrong car.

Familiarize Yourself with the Area: You can learn about the local vehicle market and find a place that offers better deals or a vehicle that suits your needs. This way, you make a more informed choice.

Reduced Initial Costs: Waiting to buy a vehicle could give you time to settle into your new financial place. It may allow you to save more money before making a purchase.

Lack of Immediate Mobility: You might struggle without a vehicle right after moving. This could limit your ability to buy groceries, go to work, or simply explore your new surroundings.

Dependence on Other Modes: If you do not have a car, you will be dependent on public transit, ride-sharing, or friends and family. This may be time-consuming and unreliable.

Potential for Delays: Getting your driver’s license, registering a vehicle, and getting insurance can take a bit of time. This may hold up your ability to drive in your new area.

Budgeting and Financial Planning for a Vehicle

Money matters greatly when you are figuring out when to buy a vehicle. How much you can spend, how to find financing, and the ongoing costs all come into play. It is vital to set a financial plan to keep things running smoothly. This will impact the choice of when to buy your car and what type to consider. Let’s delve into some key money elements involved in purchasing a vehicle.

Assessing Your Financial Situation

Before you even begin thinking about vehicles, you need to understand your current financial standing. This means looking at your income, your expenses, and any debts you may have. Make sure you know how much you can afford to put down on a car and how much you can handle monthly. You will need to take into account the cost of insurance, fuel, and upkeep. If you have any outstanding debts, think about how they will influence your vehicle-buying options.

Income Analysis: Take a look at your monthly income. After your move, your income could change because of a job change or shifts in cost of living. Understand your earnings before making financial plans for a vehicle.

Expense Review: List all your regular expenses, such as rent or mortgage, utilities, food, and other costs. Figure out how much is left over each month after paying your bills. This will help you know how much you can spend on a vehicle.

Debt Evaluation: Evaluate the debt you have. Debt payments will have an effect on your spending power. The greater your debt load, the less you will have to spend on a vehicle and related expenses.

Savings and Down Payment: Figure out how much you can save for a down payment. A larger down payment can reduce your loan amount and monthly payments. It may help you get better terms from lenders.

Emergency Fund: Make sure you have an emergency fund. Unexpected repairs or other costs can pop up when you own a vehicle. Having a backup plan will provide peace of mind and protect your budget.

Obtaining Vehicle Financing

Most people need a loan to buy a vehicle. It is important to look at various financing options to get the best interest rate and terms. Research vehicle loans from banks, credit unions, and online lenders. Understand interest rates, repayment plans, and fees. Do your research to ensure you get a favorable deal. This involves investigating your credit score, as it strongly impacts your loan conditions.

Credit Score: Your credit score strongly affects your auto loan interest rate. A higher score often leads to better terms. Check your credit score before applying for a loan and fix any errors.

Bank Loans: Banks offer vehicle loans with various terms and interest rates. Check multiple banks to find the most suitable offer. Be sure to consider their customer service and any added fees.

Credit Union Loans: Credit unions often provide competitive interest rates. They may have more flexible lending options. To become a member of a credit union, you usually must meet certain conditions.

Online Lenders: Online lenders offer quick approval processes and may provide competitive rates. Review their credibility and read reviews. Ensure they are a good match for your needs.

Loan Comparison: Compare offers from multiple lenders to find the best conditions. Consider the APR, the repayment period, and any extra fees. The goal is to obtain the most cost-effective loan.

Practical Considerations and Location Impacts

Where you live is a huge factor. The place you move to will influence your vehicle choice and when you should buy. Different areas have varied traffic, parking, and public transit. Plus, the weather and your lifestyle play key roles. These considerations help you to find a vehicle that fits your everyday life and makes the move more manageable.

Urban vs. Rural Settings

The type of place you will be moving to has a massive effect on the choice of when to buy a vehicle. If you’re moving to a city, you may not need a vehicle right away due to the wide availability of public transit and ride-sharing. But in rural areas, a vehicle might be very important. Think about the distances you’ll have to travel, parking challenges, and any costs. Consider these elements when deciding when to purchase a vehicle.

City Living: Cities usually have good public transport, so you might delay buying a vehicle. You can use buses, trains, or ride-sharing. Parking fees and traffic congestion can make vehicle ownership inconvenient.

Suburban Life: Suburbs often provide a combination of public transit and vehicle needs. Evaluate your commute to work, the distance to amenities, and the availability of public transit.

Rural Scenarios: In rural areas, a vehicle is usually a necessity because there is often no public transport. The distances between places can be greater. You may need a vehicle for work, errands, and leisure.

Parking and Traffic: Consider parking availability and traffic in your new neighborhood. City areas often have restricted parking and heavy traffic, so a smaller vehicle might be ideal.

Public Transport Access: Think about your entry to public transport from your new home. If it is convenient, it may make delaying your vehicle purchase sensible.

Vehicle Type and Needs

The kind of vehicle you require depends on your life and your location. A small, fuel-efficient vehicle might be great for city driving, while an SUV or truck may be ideal for rural environments. Also, think about your lifestyle. Do you require a vehicle for work, family duties, or hobbies? Assess these factors to find the correct type of vehicle for you and your situation.

Commuting Requirements: Your commute affects your vehicle choice. Long commutes on the highway may require a comfy, fuel-efficient vehicle.

Family Needs: If you have a family, you might require a bigger vehicle. Consider seating space, storage capacity, and safety features when choosing a vehicle.

Lifestyle Choices: Your hobbies and pursuits also affect your decision. If you go camping or hiking, an SUV or truck could be better. If you need to transport heavy items, consider a truck or van.

Fuel Efficiency: Think about fuel economy, especially if you drive a lot. Fuel-efficient vehicles can reduce expenses.

Vehicle Size: Smaller vehicles are much simpler to park and maneuver in crowded areas. SUVs or trucks provide greater space and can handle different road conditions.

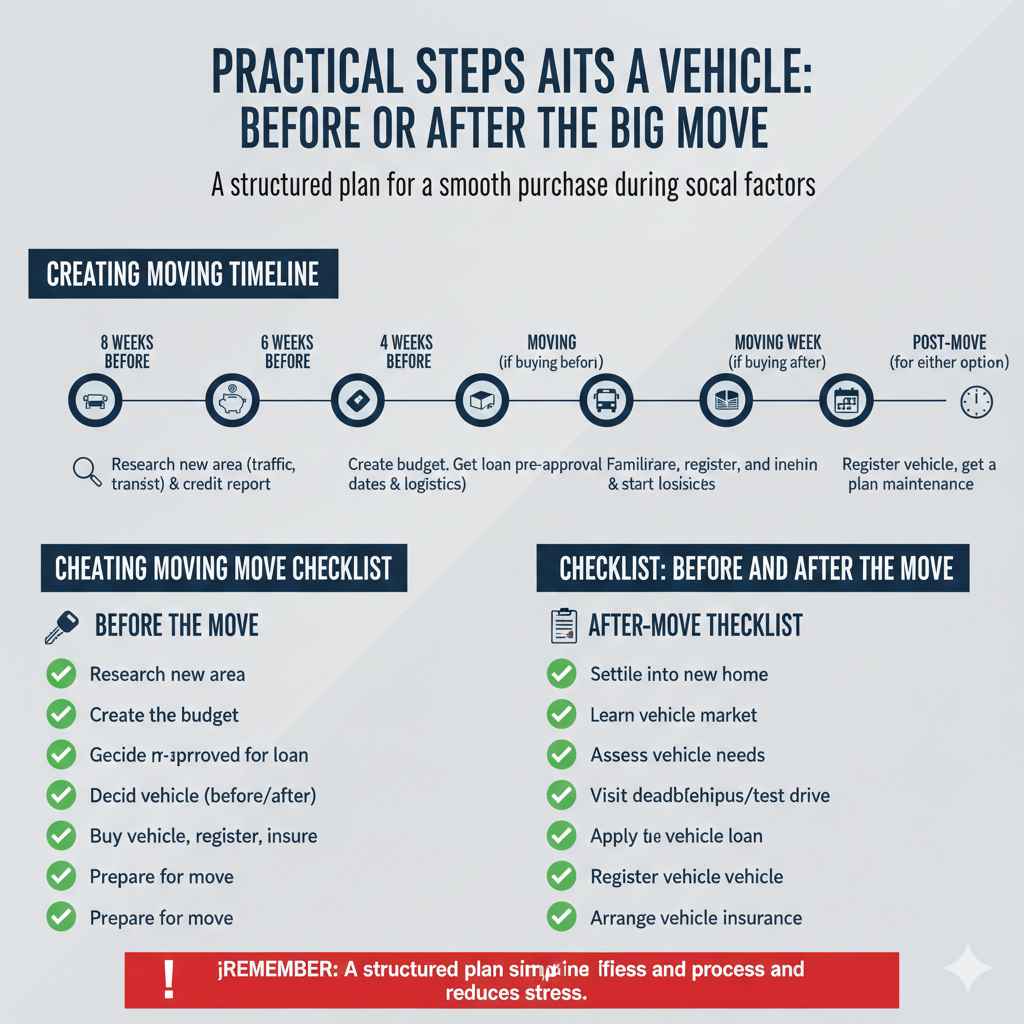

Practical Steps and a Moving Checklist

Deciding when to buy a vehicle requires careful planning. First, you need to assess your needs, make a budget, and look at the logistics of moving. A clear, well-thought-out plan will make it simpler to buy a vehicle at the right moment. Let’s explore practical steps and make a moving checklist to assist you in making the best decision for your circumstances.

Creating a Moving Timeline and Vehicle Purchase Plan

A well-organized timeline and vehicle buying plan is vital for a smooth move. Your plan should consist of critical actions. This means deciding when to purchase a vehicle. You should also consider the time needed to pack, move, and settle into your new place. Preparing well will save time and reduce stress during the move. Here’s a quick, easy example of a basic timeline:

8 Weeks Before the Move:

Start your research. Learn about the new area’s traffic, public transit, and vehicle requirements. Check your credit report to prepare for vehicle financing.

6 Weeks Before the Move:

Create a budget. Decide how much you can spend on a vehicle. Get pre-approved for a loan if you plan to buy a vehicle before moving.

4 Weeks Before the Move:

Finalize your moving plans. Confirm moving dates and logistics. This helps you figure out if you’ll have a vehicle ready at the new place.

2 Weeks Before the Move (if buying before):

Purchase the vehicle. Register the vehicle and sort out insurance. Make certain you have all the necessary documents and that everything is in order before the move.

Moving Week (if buying after):

Focus on moving. Settle into your new place. Then, start looking at vehicles and visit dealerships.

Post-Move (for either option):

Register the vehicle and get insurance. Plan your vehicle upkeep and maintenance schedule.

Checklist: Before and After the Move

A checklist will ensure you cover all your bases, from budgeting to vehicle selection. Use this to help keep you on track. Adjust the checklist depending on whether you are purchasing a vehicle before or after your move. Here is a sample:

Before the Move Checklist:

Research the new area.

Create a moving budget.

Get pre-approved for a vehicle loan.

Decide whether to buy a vehicle before or after the move.

Check vehicle prices and models.

Buy the vehicle, arrange registration and insurance.

Prepare for the move.

After the Move Checklist:

Get settled in your new house.

Learn about local vehicle markets and transport conditions.

Assess your vehicle needs.

Visit dealerships, test drive vehicles.

Apply for a vehicle loan.

Register the vehicle.

Arrange for vehicle insurance.

Frequently Asked Questions

Question: Should I buy a car if I move to a big city?

Answer: It depends. If there is reliable public transport, you may be able to delay your purchase. But you might want one if you are planning to take trips or your job is located far away.

Question: What is the best way to move a vehicle across a long distance?

Answer: If you are moving long distance, think about using a vehicle transport service. You could also drive it yourself if you prefer, depending on the distance and your budget.

Question: How do I find out about vehicle registration requirements in my new state?

Answer: Check your new state’s DMV website. You can find what documents you need and the fees that apply.

Question: What do I need to get vehicle insurance in a different state?

Answer: You usually have to give your driver’s license, vehicle registration, and proof of your previous insurance. You may also need to provide the vehicle identification number (VIN).

Question: What if I have poor credit, and I need a vehicle?

Answer: If your credit score is low, try to improve it before buying. Otherwise, look for a vehicle with a lower price, and think about getting a cosigner or a secured loan.

Final Thoughts

Deciding when to buy a vehicle, before or after you move, hinges on your unique needs. Assess your finances, your lifestyle, and the new area. Will you be in a city with many transport choices, or in a rural setting where a vehicle is important? Consider your budget and any travel needs. Also, factor in any logistical hurdles you will face. Plan beforehand to make the process run efficiently. This way, you can get a vehicle when you need it. By thinking ahead and taking the necessary actions, you can make the best choice. This will make your move much simpler.