Figuring out if Can You Pay Ford Car Payment With a Credit Card? is something many people wonder about, especially if they’re new to car payments. It can seem tricky at first, with different rules and options out there. Don’t worry, though! It’s actually pretty simple. We’re going to explore all the ways you might be able to make your Ford car payments, breaking it down step by step so you know exactly what to expect. Let’s see how this works!

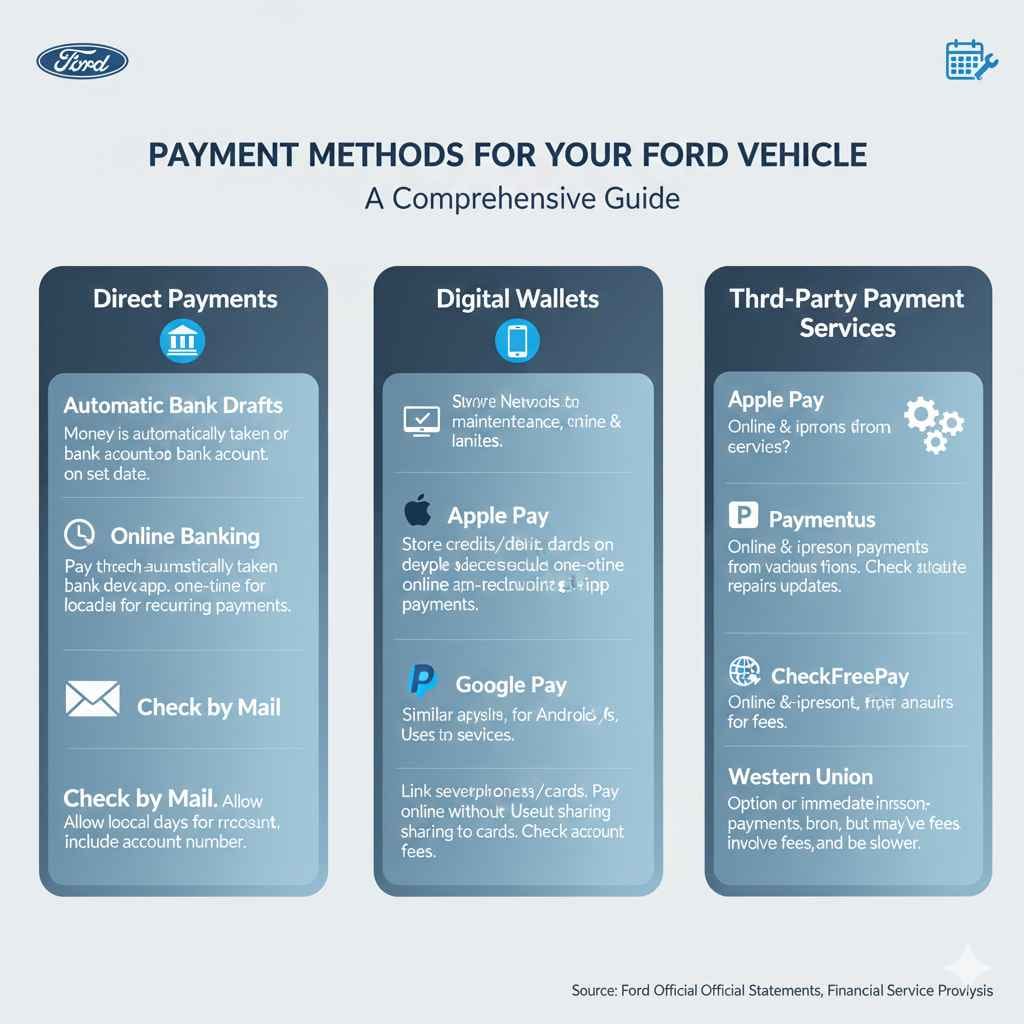

Payment Methods for Your Ford Vehicle

Paying for a car is a big deal, and how you choose to do it matters. Different payment methods come with their own benefits, like convenience or potential rewards. For your Ford vehicle, knowing all the options helps you choose what’s best for you and your finances. It’s about finding the easiest and most cost-effective way to get your bills paid on time. Explore what’s available and decide what matches your budget and your style.

Direct Payments

Direct payments involve sending money straight from your bank account to the lender. This is often a straightforward and easy option. Many people find that setting up automatic payments removes the worry of missing a due date. This direct link between your bank and the loan provider cuts out any need for third-party involvement. It ensures the money goes where it needs to go promptly and efficiently.

- Automatic Bank Drafts: Many lenders offer an automatic payment option where money is taken directly from your checking or savings account on a set date each month. This avoids late fees and ensures timely payments. This is often the most hands-off approach for managing car payments. It lets the system handle everything, so you don’t have to manually initiate a payment.

- Online Banking: You can pay your bill through your bank’s website or app. Just log in, find the bill payment section, and set up the Ford loan as a payee. You’ll need your account number, and then you can schedule one-time or recurring payments. This offers flexibility and control, allowing you to manage your payments when you have time.

- Check by Mail: Although less common now, you can still send a check via mail. This method can take a few days to process, so it’s critical to mail your payment well before the due date to avoid any penalties. Be sure to include your account number to ensure your payment gets credited to the right account.

Digital Wallets

Digital wallets offer a convenient way to pay. Instead of entering your credit card details every time, you can securely store them in apps like Apple Pay or Google Pay. This adds an extra layer of security and speeds up the payment process. They offer convenience, especially if you’re always on the go. Many people enjoy the ease of use and the fact that you can often use these wallets from your phone or other devices.

- Apple Pay: If you use an Apple device, you can add your credit or debit card to Apple Pay and use it to make payments online or in apps. This service uses a unique device-specific number and transaction code, making each payment extra secure. It is accepted at many online retailers and payment portals.

- Google Pay: Similar to Apple Pay, Google Pay allows you to store your cards and pay with your Android device. It uses tokenization to protect your card details and simplifies the payment process. You can often make payments in apps and on websites.

- PayPal: PayPal is a popular payment service where you can link your bank accounts and cards. It offers an easy way to pay without sharing your financial information with the seller. This can be especially useful when paying car bills online because you can keep your payment details secure.

Third-Party Payment Services

These services act as intermediaries between you and the lender. They often provide multiple payment methods and features like payment reminders. They can simplify the process, especially if your lender doesn’t have an easy-to-use payment portal. Keep in mind that some services may charge a fee for using their platform, so be sure to check the costs before signing up. However, the convenience and extra options are often worth the expense.

- Paymentus: This service allows you to make payments online, by phone, or through their mobile app. Paymentus works with various billers, including many auto loan providers. You might need to provide your account details and payment information to complete the transaction.

- CheckFreePay: CheckFreePay offers a range of payment options, including online and in-person payments. You can use this service to pay bills from your bank account or credit card. It’s an accessible choice that may suit a lot of users.

- Western Union: This is an option for sending payments, often used when other methods are not available or when immediate payment is needed. However, it may involve fees and could be slower than other choices. You will usually have to go to a physical location or use the online service to make a payment.

Can You Pay Ford Car Payment With a Credit Card?

The ability to use a credit card for your Ford car payments depends on your loan provider. Not all lenders accept credit card payments, or they may restrict their use to certain situations. If your lender does accept credit cards, it’s a great opportunity, as it can offer rewards, enhance your credit score, and provide some financial flexibility. Exploring all payment options ensures you can pick what works best for your needs.

Checking Your Loan Agreement

The best place to find out if you can pay with a credit card is your loan agreement. Look closely at the details about payment methods. The agreement should clearly state what forms of payment are accepted. This will prevent any confusion and guide you on what to do. If the agreement is unclear, contacting the lender directly gives you the most accurate and up-to-date information.

- Review Payment Terms: Carefully go over the section related to payments. It should list the accepted payment methods. Keep an eye out for information regarding credit cards. The terms could specify which cards are accepted or whether there are any restrictions, such as limits or fees.

- Contact Your Lender: If you don’t find the information in your loan agreement, or you need more details, reach out to your lender’s customer service. Ask them directly about using a credit card. They can clarify the current payment policies and guide you through the process.

- Check the Lender’s Website: Most lenders have websites with detailed information about managing your account and making payments. Look for a “Payments” or “FAQ” section. This may include detailed instructions on how to pay using a credit card if that option is available. The website usually has current and accurate information.

Credit Card Benefits and Drawbacks

Using a credit card for car payments has its advantages and disadvantages. Rewards programs, like cash back or travel points, make each payment more rewarding. On the other hand, interest charges can add to the total cost. Weighing these points helps you make a decision that matches your financial plans. A careful look at how each affects your money will help you pick the best method.

- Rewards Programs: Many credit cards offer rewards, like cashback, points, or miles. When you use your credit card for car payments, you earn these rewards. This can offset the cost of the interest you pay and make it more appealing to use your card.

- Interest Charges: If you carry a balance on your credit card, you’ll be charged interest. This can make your car payments more expensive over time. Paying off your card balance each month will help you avoid these extra costs.

- Building Credit: Using a credit card responsibly, by making payments on time and keeping your credit utilization low, can positively affect your credit score. This can become a huge advantage if you are building up or want to maintain a good credit profile.

Fees and Additional Charges

Be aware of any fees associated with using a credit card for car payments. Lenders might charge a convenience fee for accepting credit card payments, which can make it a less attractive option. Be sure you consider all costs to pick the most budget-friendly method. Knowing all the charges can help you avoid unwelcome surprises and manage your finances well. Always confirm any fees before completing a payment.

- Convenience Fees: Some lenders charge a small fee for processing credit card payments. This fee is in addition to your monthly payment and is a cost you will bear. These fees can range from a percentage of the payment to a flat amount.

- Interest on Unpaid Balances: If you don’t pay off your credit card balance in full each month, you’ll be charged interest. This interest can increase the total cost of your car payments. Knowing your interest rate is key to managing the cost.

- Late Payment Fees: Missing a payment, whether paying with a credit card or other means, can result in late fees. Always pay your bills on time to prevent these charges. Set up reminders or automatic payments to ensure you don’t miss any due dates.

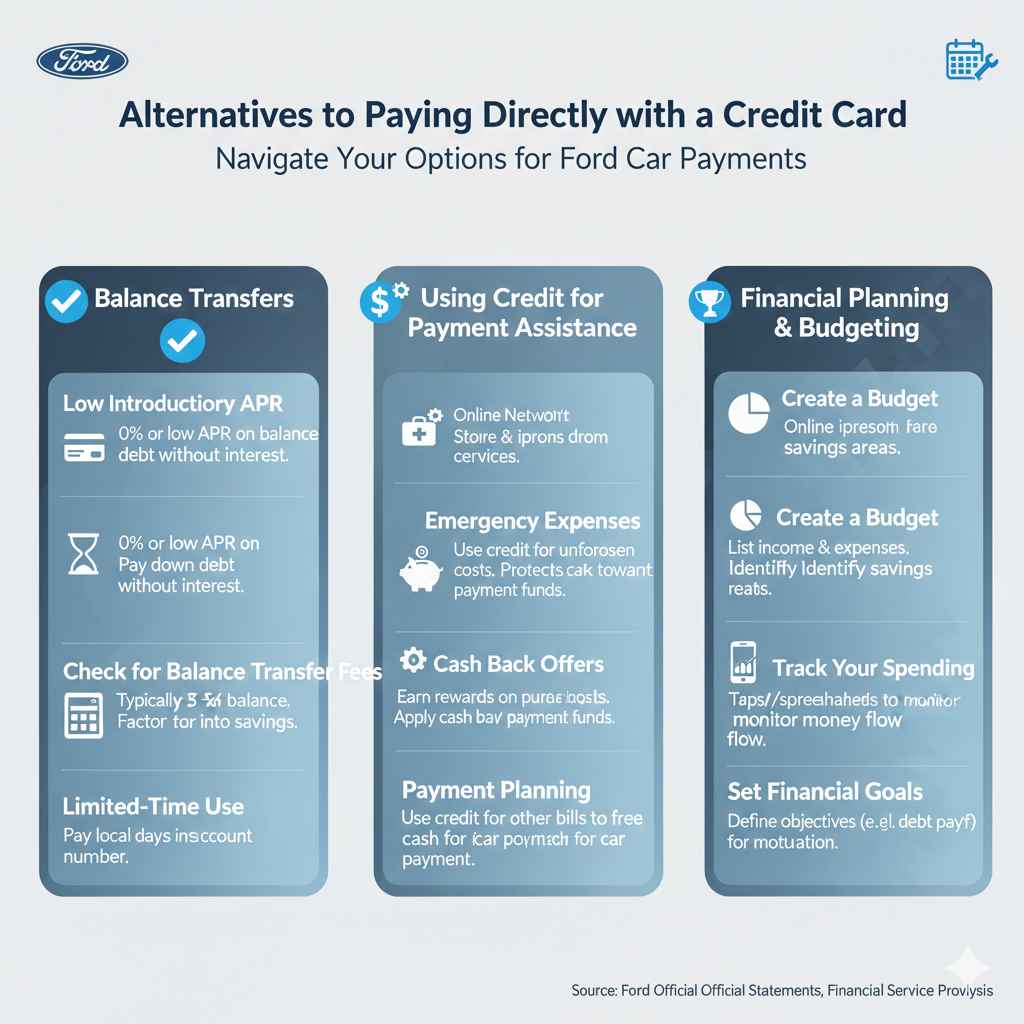

Alternatives to Paying Directly with a Credit Card

Even if you can’t pay your Ford car payment directly with a credit card, other methods may still offer some of the same benefits. You can find creative ways to use credit to your advantage without directly using your card for payments. Many of these alternatives allow you to earn rewards or benefit from your credit. Explore various options, so you know all the possible ways to manage your debt and budget.

Balance Transfers

A balance transfer involves moving your car payment debt to a credit card with a lower interest rate, offering the opportunity to reduce interest charges. Carefully consider the terms, including any fees and the interest rate of the new card. This method provides temporary relief from high interest and can make paying down the debt less costly. Evaluate this method in the context of the overall cost and savings.

- Choose a Card with a Low Introductory APR: Look for cards that offer a 0% or low introductory annual percentage rate (APR) on balance transfers. This gives you a period to pay down your debt without incurring interest charges. Ensure that you’ll be able to pay off the balance before the introductory period ends to make it worthwhile.

- Check for Balance Transfer Fees: Many cards charge a fee, typically 3% to 5% of the transferred balance. Factor this fee into your calculations to see if the lower interest rate saves you money overall. Sometimes, the fee negates the benefit, so it is crucial to assess thoroughly.

- Use the Transfer for a Limited Time: Pay down the debt during the introductory period. Be sure to stick to a plan and avoid adding more debt to the card. This technique can be a powerful tool, but it works only if it’s used with discipline.

Using Credit for Payment Assistance

You may also utilize your credit cards in indirect methods to manage your payments or ease your budget. This can include using a credit card for emergencies or other expenses. Such approaches offer some financial flexibility. Ensure you do not overspend, and make a plan to repay the balance, avoiding excessive interest and fees. These tools will help you to maintain good credit while controlling your debt.

- Emergency Expenses: If an unforeseen expense arises, you could use your credit card. This allows you time to cover the cost without sacrificing your car payment. But it is only suitable for unplanned expenditures, not for routine monthly payments.

- Cash Back Offers: Some credit cards give you cash back on certain purchases. You could then use that cash back toward your car payment. This is another indirect way of making your payments easier to manage. Remember, this option is less about direct payment and more about maximizing rewards and benefits.

- Payment Planning: Consider using your credit card for other expenses to free up cash. If you have enough cash for a car payment, you could use a credit card for other needs and then use that freed-up money to pay the car loan. Carefully budget and make sure you do not add more debt.

Financial Planning and Budgeting

Financial planning is critical when it comes to managing car payments. A budget helps track where your money goes. A clear financial plan helps you make choices that lead to debt reduction. These steps will help you handle your car payments and any other debt you may have. It’s about building a solid plan that works for you.

- Create a Budget: List all your income and expenses to see where your money goes. This will help you identify areas where you can save money, perhaps to put toward your car payment or other financial goals. A good budget sets the framework for all your finances.

- Track Your Spending: Use budgeting apps or spreadsheets to keep a close eye on your spending. This helps identify where your money goes each month. This level of detail helps you better manage your finances and avoid overspending.

- Set Financial Goals: Define your financial objectives, like paying off debt or saving for something. These goals motivate you and make your financial planning more effective. Break down your goals into smaller, manageable steps.

Frequently Asked Questions

Question: Can I earn rewards when I pay my Ford car payment with a credit card?

Answer: It depends on your lender and credit card. If your lender allows credit card payments, you can earn rewards like cash back or points on your card. However, be aware of any fees that might negate the benefit.

Question: What happens if I miss a payment when using a credit card?

Answer: You may face late fees from both your lender and your credit card issuer. It can also damage your credit score, making it harder to get loans in the future. Always make sure to pay on time.

Question: Can I pay my Ford car loan with a prepaid credit card?

Answer: This option is less common. Loan providers might not accept prepaid cards. Your best bet is to check with your loan provider directly. They can tell you their specific policies.

Question: Is there a fee to use a credit card for my Ford car payment?

Answer: Yes, some lenders charge a convenience fee for processing credit card payments. This fee will depend on your lender. This could be a percentage of your payment or a flat fee.

Question: What if my lender does not accept credit cards for payments?

Answer: If your lender doesn’t take credit cards, you can still explore other ways to pay, such as direct debit, online banking, or setting up a bill payment through your bank. If you want to use credit, you might use balance transfers or cash back offers.

Final Thoughts

Knowing Can You Pay Ford Car Payment With a Credit Card? involves checking directly with your lender. Even if you can’t pay your car payment directly with a credit card, you still have options. You can look into balance transfers or use your credit card for other expenses. Create a clear budget, and track your money to make informed choices. By being smart about your finances, you’ll find a way to manage your car payments. You don’t have to feel lost. By following these steps, you will make the most of your money.