Are you paying too much for car insurance without even realizing it? Knowing the best time to compare car insurance quotes can save you hundreds of dollars and give you peace of mind.

But when exactly should you start looking for better deals? Timing can make a huge difference in the options and prices you find. Keep reading to discover the perfect moments to shop around and how doing it right can protect your wallet and your ride.

Your next smart move starts here.

Why Timing Matters

Timing plays a key role in comparing car insurance quotes. Prices can change depending on when you check. Understanding the right time helps you save money and get better deals.

Impact Of Timing On Premiums

Car insurance premiums can vary throughout the year. Insurers adjust prices based on many factors like market changes and claims data. Checking quotes at the right moment can mean lower premiums. Some months may show higher prices due to more claims or risks. Early renewal or comparing quotes before your current policy ends often brings better rates.

Seasonal Trends In Insurance Rates

Insurance rates often follow seasonal patterns. For example, rates might rise in winter because of more accidents. Summer may bring fewer claims, leading to lower premiums. Some insurers offer discounts during slow seasons to attract new customers. Watching these trends helps you pick the best time to compare quotes.

Credit: www.experian.com

Best Times To Compare Quotes

Knowing the best times to compare car insurance quotes can save you money and stress. Timing matters because insurance rates change based on many factors. Comparing quotes at the right moments helps you find better deals and coverage.

Before Policy Renewal

Check your car insurance quotes before your policy ends. This period is perfect to review your current coverage and prices. Insurers often offer discounts to keep customers at renewal time. Comparing quotes now can help you decide if you should switch or stay.

After Major Life Events

Life changes affect your insurance needs. Events like moving, marriage, or a new job can change your risk level. After these events, compare quotes to see if you qualify for lower rates. Updating your policy can save money and give better protection.

During Promotional Periods

Insurance companies run special deals at certain times of the year. These promotions can include lower premiums or extra benefits. Compare quotes during these periods to take advantage of discounts. Acting quickly during promotions often leads to the best savings.

Factors Influencing Quote Variations

Car insurance quotes change for many reasons. Knowing these reasons helps you find the best time to compare quotes. Price differences depend on outside and personal factors. These can affect your monthly payments a lot. Understanding these factors makes shopping for insurance easier.

Market Competition

Insurance companies compete to get more customers. When many companies offer deals, prices tend to drop. New companies joining the market can lower rates. Big companies may change prices to keep clients. This creates chances to find lower insurance costs.

Regulatory Changes

Government rules affect how insurance companies set prices. New laws can raise or lower premiums quickly. Changes in required coverage impact quote amounts. Sometimes, states change how claims are handled. These rules influence the cost of your policy.

Personal Driving Record Updates

Your driving record is important for insurance rates. Traffic tickets or accidents can raise your premiums. Clean records often get better discounts over time. Reporting changes in your driving habits can lower costs. Keeping a good record helps maintain lower quotes.

Credit: www.moneygeek.com

Tips To Maximize Savings

Saving money on car insurance is possible with smart strategies. Simple actions can lower your premiums. Knowing the right steps helps you get the best deal. Use these tips to maximize your savings and reduce costs.

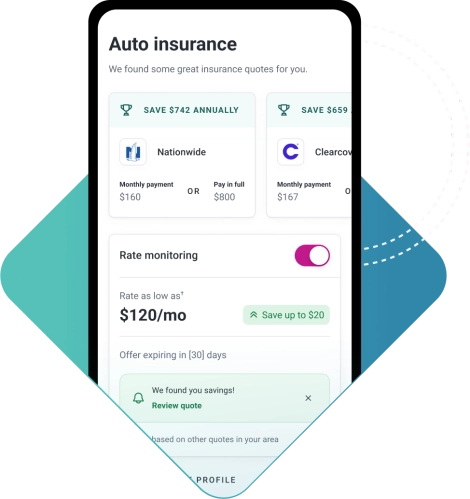

Using Online Comparison Tools

Online tools show different insurance quotes quickly. You can compare prices from many companies in minutes. These tools are easy to use and free. They help spot the cheapest rates and best coverage. Check quotes regularly to catch new discounts.

Bundling Insurance Policies

Many insurers offer discounts when you combine policies. Bundling car and home insurance saves money. It also makes managing payments easier. Ask your insurer about bundling options. This simple step often cuts your total costs.

Negotiating With Insurers

Talking to your insurer can lower your rates. Mention any better offers you found elsewhere. Ask about discounts for good driving or safety features. Being polite but firm works best. Negotiation can lead to extra savings on your premium.

Common Mistakes To Avoid

Comparing car insurance quotes is important to save money and get the right coverage. Many people make mistakes that cost them time and money. Avoid these common errors to make the best choice for your insurance needs.

Waiting Too Long To Compare

Waiting to compare quotes can lead to higher prices. Insurance rates change often. New discounts may become available. Start comparing before your current policy ends. Early action gives more time to find better deals.

Ignoring Policy Details

Focus on more than just the price. Check what each policy covers. Look for limits, deductibles, and exclusions. Some cheaper policies may not cover all risks. Understanding details helps avoid surprises later.

Failing To Update Personal Information

Keep your information current with insurers. Changes in address, driving habits, or car use affect rates. Old information can cause inaccurate quotes. Update details before comparing to get true prices.

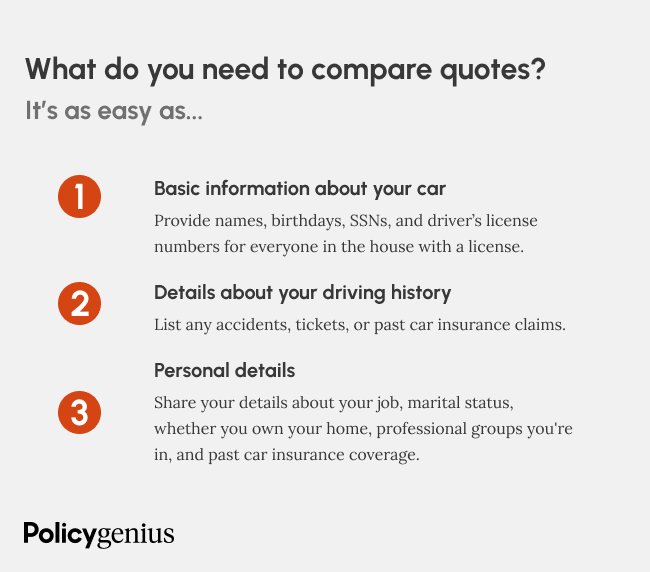

Credit: www.policygenius.com

Frequently Asked Questions

When Is The Best Time To Compare Car Insurance Quotes?

The best time to compare car insurance quotes is before your current policy expires. Also, shop around after major life changes or annually to find better deals.

How Often Should I Compare Car Insurance Quotes?

It’s wise to compare quotes at least once a year. This helps ensure you get the best coverage at the lowest price.

Can Comparing Quotes Save Me Money On Car Insurance?

Yes, comparing quotes can reveal cheaper options. Different insurers offer varied rates based on your profile and driving history.

Should I Compare Quotes After Buying A New Car?

Absolutely. New cars may require different coverage. Comparing quotes helps you find the best policy tailored to your new vehicle.

Conclusion

Comparing car insurance quotes saves money and stress. Prices change often, so check regularly. Start before your current policy ends. Early comparison helps find the best deal. Don’t wait for accidents or tickets. Small differences in coverage can matter a lot.

Spend time now, avoid costly surprises later. Keep your information ready for quick quotes. Remember, smart timing leads to better choices. Stay informed and protect your wallet. Simple steps make a big difference.