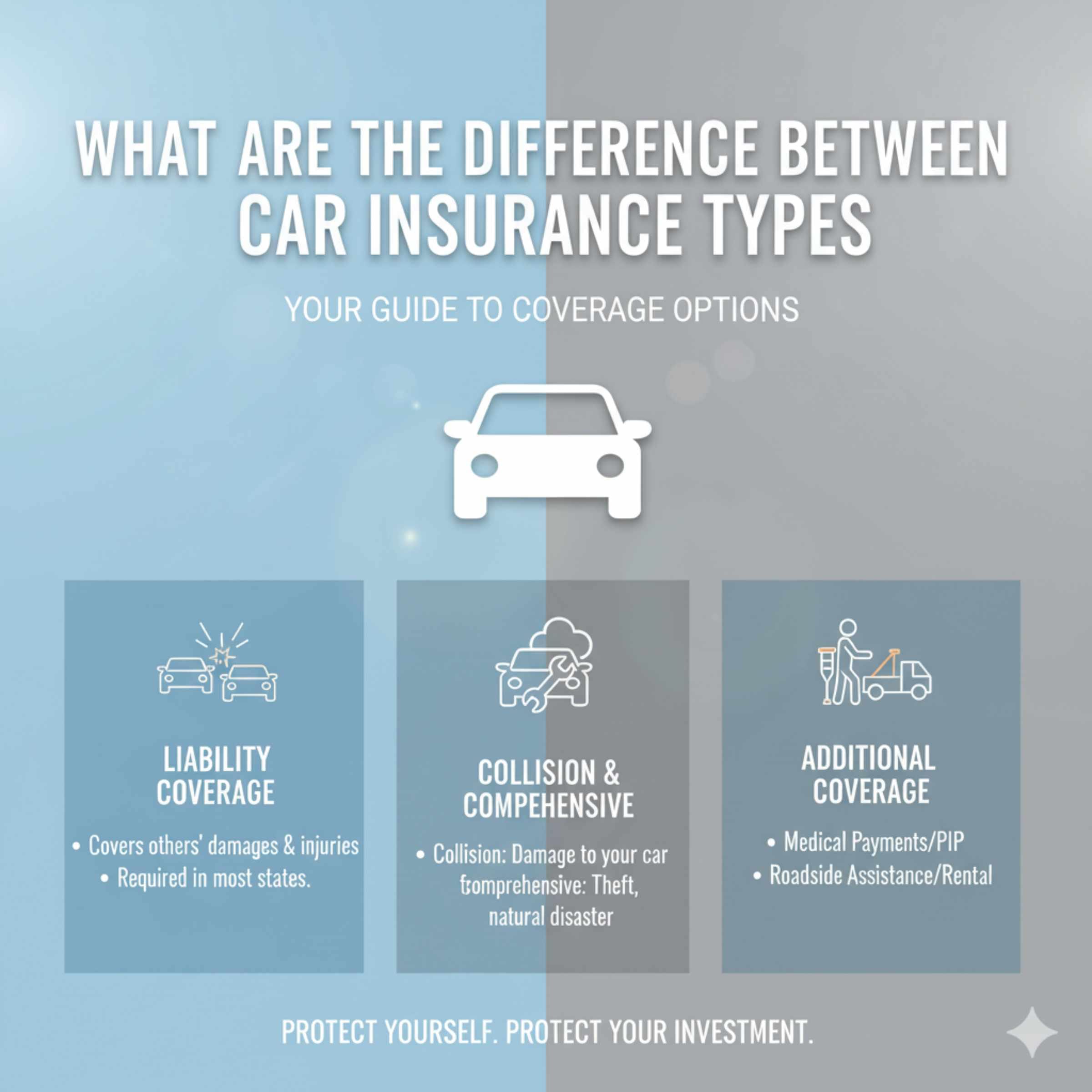

The difference between car insurance types boils down to what risks you want to cover. Basic coverage (Liability) pays for others if you’re at fault. Full coverage (Liability plus Collision/Comprehensive) pays for your car too, offering peace of mind but costing more. We break down every term simply here.

Hello there! I’m Dustin Hall, and if looking at your car insurance policy feels like reading an ancient map, you are definitely not alone. It’s frustrating when you need to understand what you’re paying for, but terms like “Deductible,” “Collision,” and “Uninsured Motorist” sound like gibberish. Choosing the right insurance doesn’t have to be a headache. It’s about making sure you and your ride are protected without overpaying for coverage you don’t need. We are going to simplify every major car insurance type today. By the end of this easy guide, you’ll feel confident choosing the right plan for your everyday driving life. Let’s demystify insurance together!

Understanding the Basics: Why Car Insurance Matters

Car insurance isn’t just a piece of paper the DMV requires; it’s your financial safety net on the road. Think of it like a promise: if something unexpected happens—a fender bender, a tree branch falling, or worse—your insurance steps in to cover the costs, saving you from huge personal bills.

The Core Concept: Liability vs Full Coverage

When people talk about car insurance types, they are usually speaking about two main buckets:

1. Liability Coverage: This is the minimum legally required in most states. It covers other people when you are at fault.

2. Full Coverage: This is a combination of Liability coverage plus coverage for your own vehicle (Collision and Comprehensive).

The biggest difference hinges on what happens to your car in an accident that is your fault. Does your policy pay to fix your car, or do you? That’s the key question we’ll answer by exploring the individual components.

The Six Essential Types of Car Insurance Coverage

To truly understand what you are buying, you need to know the six major types of coverage that make up a standard policy. It’s helpful to think of these like building blocks for your protection plan.

1. Liability Coverage (The Legal Must-Have)

Liability insurance is mandatory almost everywhere because it protects other drivers, not you, if you cause an accident.

It is broken down into two essential parts:

Bodily Injury Liability (BI)

This pays for injuries or death you cause to other people in an accident. This includes medical bills, lost wages, and pain and suffering for the other party. Because medical costs can skyrocket instantly, having high BI limits is crucial for protecting your personal assets (like your savings or home) if you’re sued.

Property Damage Liability (PD)

This covers the damage you cause to other people’s property. This usually means their car, but it can also cover things like a fence, a mailbox, or a storefront you hit.

Quick Tip: Liability limits are often written as three numbers, like 25/50/25. This means $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage per accident.

2. Collision Coverage (Your Car, Your Fault)

Collision coverage pays to repair or replace your vehicle if it is damaged in a crash with another car or object (like a guardrail or a telephone pole), regardless of who was at fault.

If you financed or leased your car, your lender will almost always require you to carry Collision coverage to protect their investment.

3. Comprehensive Coverage (Non-Collision Damage)

Comprehensive coverage handles damage to your car that is not caused by a collision. Think of it as the coverage for life’s weird accidents.

This includes things like:

- Theft or vandalism

- Fire or explosion

- Damage from natural events (hail, flood, wind)

- Hitting an animal (like a deer)

- Damage from falling objects (tree limbs)

4. Personal Injury Protection (PIP) or Medical Payments (MedPay)

These cover medical expenses and sometimes lost wages for you and your passengers, regardless of who caused the accident. The difference between PIP and MedPay often depends on your state:

MedPay: Generally simpler, covering only medical bills up to the limit you choose.

PIP: More comprehensive, covering medical bills, lost wages, and essential services you can no longer perform (like childcare). PIP is mandatory in “No-Fault” states, meaning you go through your own insurance first after any accident.

For more information on how different states mandate coverage, you can check resources from the Insurance Information Institute, a reputable industry resource, which details state-by-state requirements.

5. Uninsured/Underinsured Motorist Coverage (UM/UIM)

This is vital protection for when the other driver is at fault but lacks adequate insurance.

Uninsured Motorist (UM): Covers your injuries or property damage if the at-fault driver has noinsurance.

Underinsured Motorist (UIM): Kicks in when the at-fault driver’s insurance limit is too low to cover all your costs.

If you live in an area with high rates of uninsured drivers, this coverage is non-negotiable for your safety.

6. Other Important, Optional Coverages

Many drivers add these endorsements to round out their protection:

Rental Reimbursement: Pays for a rental car while your vehicle is being repaired after a covered claim.

Roadside Assistance: Covers towing, flat tire changes, jump-starts, and lockout service.

Gap Insurance: Crucial if your car is new or leased. If your totaled car is worth less than what you still owe the bank (the “gap”), Gap Insurance pays the difference.

Comparing the Main Insurance Packages: Liability vs. Full Coverage

Now that you know the components, let’s put them together to see the main choices drivers face.

What is Liability-Only Insurance? (The Bare Minimum)

Liability-only coverage only carries the mandatory Bodily Injury Liability and Property Damage Liability components.

Pros of Liability-Only:

- Much lower monthly premiums.

- Simplest form of coverage.

- Often allowed if your car is older and paid off.

Cons of Liability-Only:

- If you cause an accident, your own car is not repaired by your insurance.

- You have no protection if your car is stolen or damaged by weather.

- If you are hit by an uninsured driver, you have to pay all your own recovery costs unless you carry UM/UIM separately.

What is Full Coverage Insurance? (Bumper-to-Bumper Safety)

Full coverage is not a single official policy type but a term used to describe a policy that includes Liability PLUS Collision and Comprehensive coverage.

Pros of Full Coverage:

- Your vehicle is protected against almost every common risk, including accidents you cause, theft, and weather damage.

- Required by lenders for financed or leased vehicles.

- Provides maximum peace of mind.

Cons of Full Coverage:

- Significantly higher monthly premiums.

- You must pay a Deductible before the insurance pays out for Collision/Comprehensive claims.

The Role of the Deductible: How You Share the Cost

Regardless of whether you choose Full Coverage, the concept of the Deductible applies to Collision and Comprehensive claims. This is one of the most important concepts to grasp to understand your final costs.

A Deductible is the fixed amount of money you agree to pay out-of-pocket beforeyour insurance company starts paying for a covered claim.

For example, if you have a $500 deductible and $4,000 worth of damage comes from a tree branch falling on your car (a Comprehensive claim):

- You pay the first $500 to the body shop.

- Your insurance company pays the remaining $3,500.

Choosing Your Deductible Wisely

The level of your deductible directly impacts your premium (how much you pay each month).

| Deductible Level | Monthly Premium Impact | Out-of-Pocket Risk |

|---|---|---|

| Low Deductible ($250 or $500) | Higher | Lower (You pay less if you crash) |

| High Deductible ($1,000 or more) | Lower | Higher (You pay more if you crash) |

Dustin’s Take: If you have a healthy emergency fund saved up, choosing a slightly higher deductible (like $1,000) can often save you significant money on your monthly bill. However, if you couldn’t easily come up with $1,000 tomorrow, stick with a lower deductible for safety.

How Coverage Types Apply to Different Drivers

What’s right for one driver might be wrong for another. Your decision should center on two main factors: state law and the age/value of your car.

Scenario 1: The Very New or Financed Car Owner

If you have a car loan or lease, you must carry Full Coverage (Collision and Comprehensive) because the bank or leasing company needs protection for their asset. You also want Rental Reimbursement and Gap Insurance.

Scenario 2: The Older, Paid-Off Car Owner

If your car is paid off and its market value isn’t high (e.g., it’s worth less than $4,000), paying high premiums for Collision and Comprehensive might not make financial sense. If a major repair costs more than the car is worth, the insurance company will “total” it—meaning you get their settlement amount. In this case, Liability-Only plus strong UM/UIM coverage might be the smartest money move.

Scenario 3: The Driver in a “Tort” State vs. a “No-Fault” State

This is where the law dictates choices. Most states are “Tort” states, meaning the at-fault driver (and their Liability insurance) pays for damages. However, some states, like Michigan or Florida, use a “No-Fault” system where your PIP coverage pays for your immediate medical bills regardless of fault.

If you live in a No-Fault state, understanding PIP is far more important than focusing strictly on Liability limits alone, as your own insurance is the first line of defense.

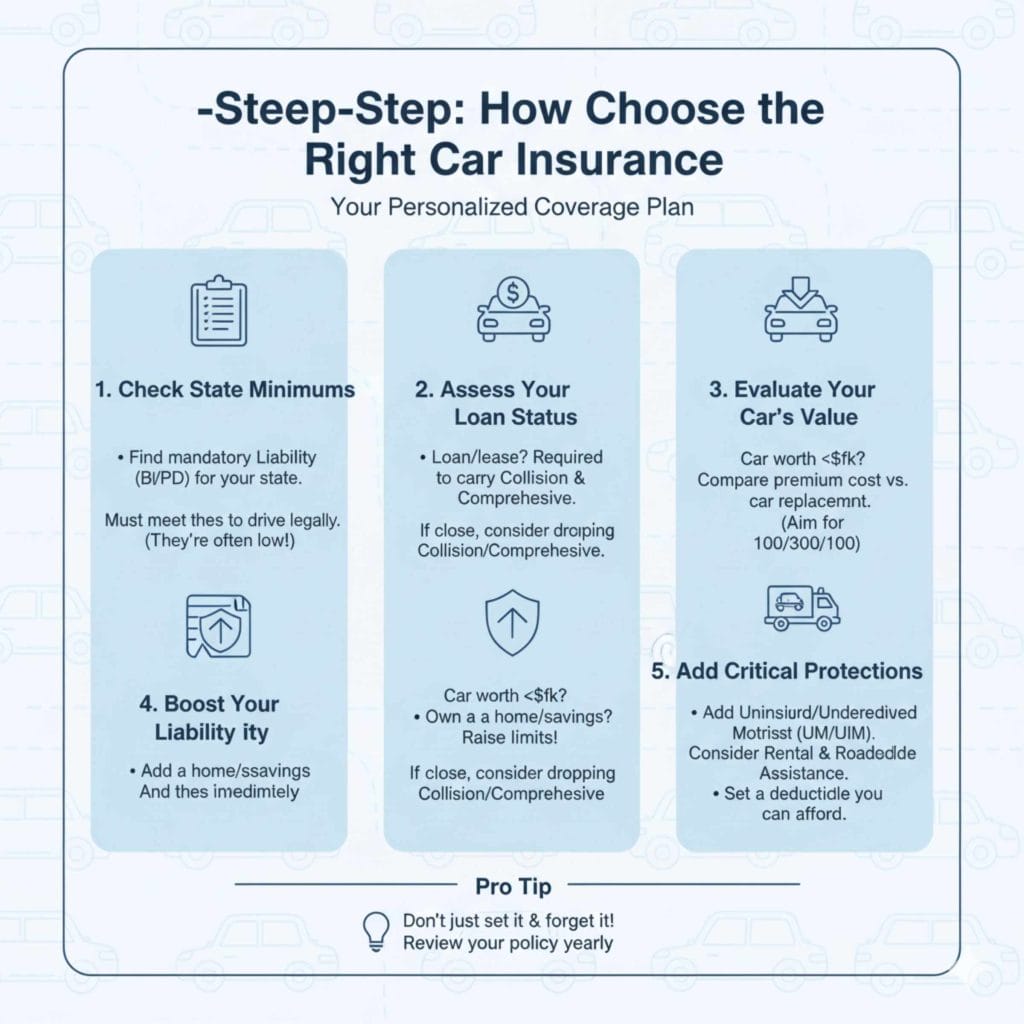

Step-by-Step: How to Choose the Right Mix for You

Don’t just grab the basic package. Follow these steps to build a confident plan tailored to your life.

- Check State Minimums First: Look up the mandatory Liability minimums (BI/PD) for your state. You must meet these just to drive legally. (A driver in California, for instance, must carry at least $15,000/$30,000/$5/$10,000 liability limits, but these are low!)

- Assess Your Loan Status: If you have a loan or lease, you are required to carry Collision and Comprehensive. Add these immediately.

- Evaluate Your Car’s Value: If your car is worth less than $5,000, start comparing the cost of Collision/Comprehensive premiums against the cost of replacing the car yourself. If the yearly premium is close to the car’s value, drop the coverage.

- Boost Your Liability: This is the most critical step for personal asset protection. If you have significant savings or own a home, raise your Liability limits well above the state minimums (aim for 100/300/100 if possible).

- Add Critical Protections: Always strongly consider adding Uninsured/Underinsured Motorist (UM/UIM) coverage—it protects you when others break the rules. Add Rental and Roadside Assistance if they fit your budget.

- Set Your Deductible: Once Collision/Comprehensive are on the policy, decide on a deductible you can comfortably afford to pay in an emergency.

Frequently Asked Questions (FAQs) for New Drivers

Q: Is “Full Coverage” the same as having the maximum insurance possible?

A: No. “Full Coverage” simply means you have Liability plus Collision and Comprehensive. You can still have very low Liability limits even with Collision coverage, which would leave you exposed financially if you cause a major accident.

Q: What is the difference between Comprehensive and Collision?

A: Collision covers crashes with other vehicles or objects. Comprehensive covers everything else—theft, fire, hail, vandalism, and animals. Think Collision for hitting something, Comprehensive for something hitting you (or nature attacking your car).

Q: If I live in a state that doesn’t require insurance, can I drive without it?

A: While financially risky, some states (like New Hampshire, though this is changing) allow drivers to show proof of financial responsibility in other ways. However, driving without insurance is extremely dangerous. If you cause an accident, you could face massive medical bills and potential license suspension. For safe driving, insurance is always recommended.

Q: How does my driving record affect the type of insurance I get?

A: Your driving record (accidents, tickets) doesn’t change the typesof coverage available (Liability, Collision, etc.). It heavily affects your price. Safe drivers get the best rates across all coverage types because they are statistically less risky to insure.

Q: What form of insurance covers me if I borrow a friend’s car?

A: Usually, your own auto insurance policy follows you*, not the car. If you have Liability coverage on your own policy and borrow a friend’s car, your Liability coverage will typically extend to cover damages you cause while driving their car. However, your own Collision/Comprehensive won’t cover damage to their car unless you specifically purchased “Other Than Collision” coverage on your own policy.

Q: Should I buy Gap Insurance if my car is brand new?

A: If you financed or leased the vehicle, yes, you should seriously consider Gap Insurance for the first few years. Cars depreciate quickly, and if it’s totaled shortly after you buy it, the standard Collision payout might not cover the full loan balance. You can often purchase Gap coverage through your primary auto insurer or directly from your lender.

Conclusion: Taking Control of Your Policy

Understanding what is the difference between car insurance types moves you from being a confused buyer to a confident consumer. Remember this: Liability is for protecting others’ assets, while Collision and Comprehensive protect your car. PIP and UM/UIM protect your personal well-being when things go wrong.

When you call your agent next, you now have the power to ask specific, informed questions: “What is my deductible on Comprehensive?” or “Are my UM/UIM limits high enough to cover a major injury claim?” By customizing your coverage based on your car’s value, your financial standing, and your state’s laws, you ensure you have the right shield in place for the road ahead. Drive safely, and stay protected!