Thinking about buying a car? Before you get excited about your new ride, it’s important to know all the fees that come with it.

You might expect to pay just the sticker price, but there are extra costs that can surprise you. Knowing these fees upfront can save you money and stress later. You’ll discover every fee involved in buying a car, so you can make smart choices and avoid hidden charges.

Keep reading to get the full picture and take control of your car purchase.

Base Price Vs Total Cost

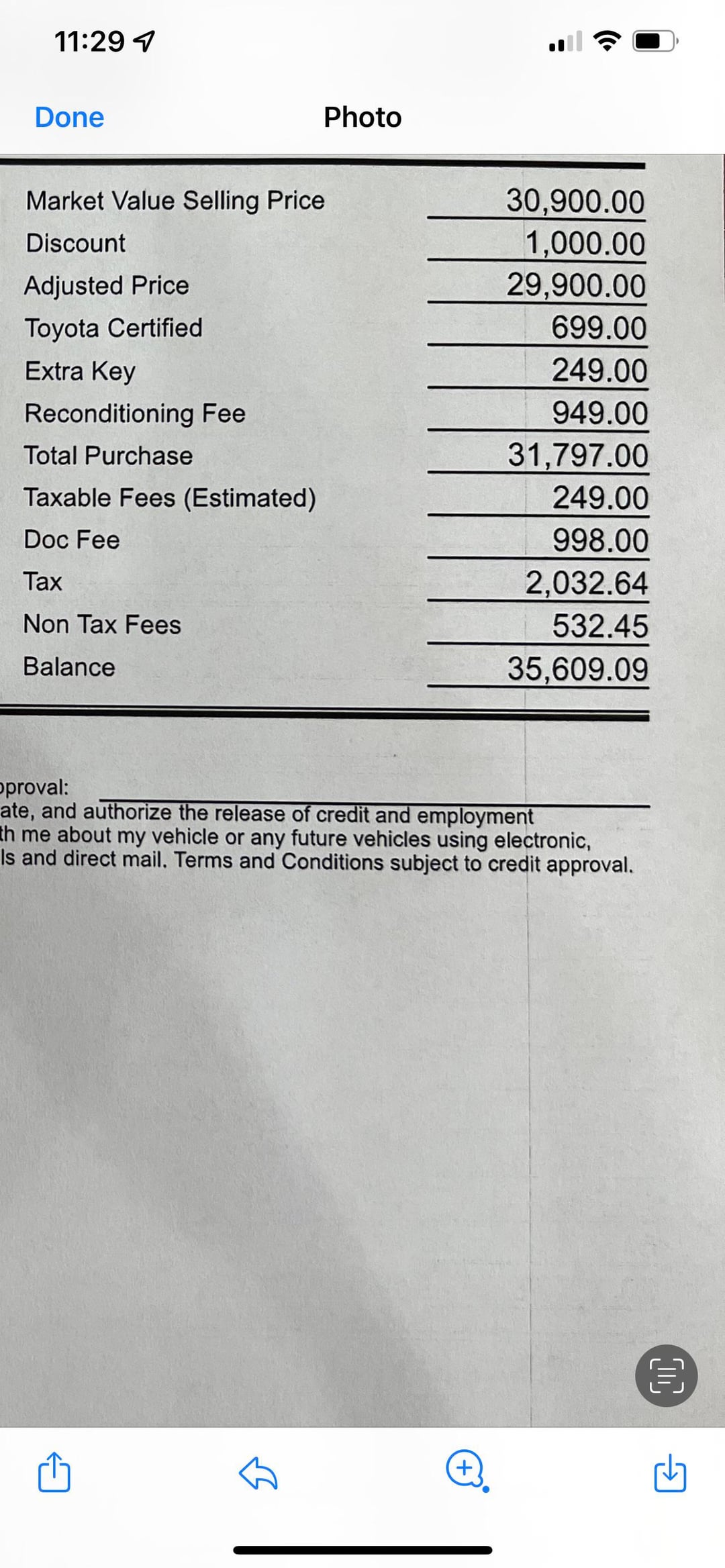

Understanding the difference between the base price and total cost of a car is important. The base price is just the starting point. It shows the cost of the car without extra charges. The total cost includes all the fees you pay to own the car. This can surprise many buyers at the dealership.

Knowing these costs helps you plan your budget better. It also prevents surprises at the payment counter. Let’s break down these costs into clear parts.

Sticker Price Breakdown

The sticker price is the number you see on the car window. It shows the base price plus some added fees. These fees include the manufacturer’s destination charge. This covers the cost of shipping the car to the dealer. The sticker price may also include options you choose, like special paint or upgrades.

Taxes are not on the sticker price. They come later when you buy the car. The sticker price gives a good starting point but not the full cost.

Additional Dealer Fees

Dealers add extra fees to cover their costs. These fees are not part of the sticker price. They can include documentation fees for paperwork. Dealers may also charge a fee for preparing the car for sale. This is called the dealer prep fee.

Some dealers add advertising fees or market adjustment fees. These costs vary by location and dealer. Always ask for a full list of dealer fees. These fees increase the total price you pay.

Taxes And Government Charges

Taxes and government charges add to the total cost of buying a car. These fees vary by location and can impact your budget. Understanding these charges helps you prepare for the full price, not just the sticker price.

Sales Tax Variations

Sales tax on a car depends on your state or country. Some places charge a high percentage, while others have lower rates. The tax is usually a percentage of the car’s price. New and used cars may have different tax rates. Check local rules to know the exact amount you will pay.

Registration And Title Fees

Registering your car is mandatory in most places. This fee covers the cost to record your vehicle officially. Title fees show proof you own the car legally. Registration and title fees vary widely by state or region. These fees can be a fixed amount or based on the vehicle’s value. Budget for these charges to avoid surprises after buying.

Dealer Add-ons

Dealer add-ons are extra services or products offered by the car dealer. These add-ons can increase the total price of your car. Knowing about these fees helps you plan your budget better. Some add-ons are useful, while others you might not need.

Extended Warranties

Extended warranties protect your car beyond the factory warranty. They cover repairs and parts for a longer time. These warranties cost extra money but can save you on repair bills. Always check what the warranty covers before buying.

Insurance And Protection Plans

Dealers often sell insurance and protection plans. These include gap insurance, paint protection, and theft protection. These plans add security but come with extra fees. Consider if you really need these plans or if you have coverage elsewhere.

Documentation Fees

Documentation fees cover the dealer’s cost to process paperwork. This fee is charged for preparing the sale documents. It can vary by dealer and state. This fee is non-negotiable and usually appears on the final bill.

Credit: www.autotrader.com

Financing Costs

Financing costs are a key part of buying a car. These costs affect the total price you pay over time. Understanding them helps you plan your budget better. Financing means borrowing money to pay for the car. You then repay this money in monthly installments.

Loan Interest Rates

Loan interest rates are the fees charged for borrowing money. They are shown as a percentage of the loan amount. Lower interest rates mean you pay less extra money. Rates vary based on your credit score and lender. Small changes in rates can change your total cost a lot.

Loan Origination Fees

Loan origination fees are charges for setting up the loan. Lenders use this fee to cover paperwork and processing. This fee is usually a percentage of the loan amount. Not all loans have this fee, so check carefully. Paying this fee upfront can reduce your monthly payments.

Impact On Monthly Payments

Financing costs directly affect how much you pay each month. Higher interest rates or fees increase monthly payments. Lower costs mean smaller payments and easier budgeting. Knowing your monthly payment helps you choose the right loan. Always compare different loan offers before deciding.

Insurance Expenses

Insurance expenses are a key part of the total cost when buying a car. They protect you from financial loss in accidents or theft. Understanding insurance costs helps you budget better. These expenses include different types of coverage. Each type serves a specific purpose and has its own cost.

Mandatory Coverage

Most states require minimum car insurance by law. This usually includes liability coverage. Liability insurance pays for damage or injury you cause to others. It does not cover your own car. The cost depends on your driving record and location. Skipping this coverage can lead to fines or license suspension.

Optional Additions

Optional insurance covers more than the legal minimum. Collision coverage pays for damage to your car after an accident. Comprehensive coverage protects against theft, fire, or weather damage. You can also add uninsured motorist coverage. This helps if another driver has no insurance. These extras increase your premium but offer more protection.

Credit: www.etsy.com

Pre-delivery And Inspection Fees

Pre-delivery and inspection fees are common charges when buying a car. These fees cover the work dealers do before handing over the vehicle to the buyer. They ensure the car is clean, safe, and ready to drive.

These fees help protect buyers from hidden problems. They include preparing the vehicle and running safety tests. Understanding these costs can help you plan your budget better.

Vehicle Preparation Charges

Vehicle preparation charges cover cleaning and minor fixes. Dealers wash the car inside and out. They also check fluids and top them up if needed. Small repairs might be done to ensure the car looks good. These steps make sure the car is presentable and ready for you.

Inspection And Emission Tests

Inspection fees pay for safety and quality checks. Dealers test brakes, lights, and tires to confirm they work well. Emission tests check how much pollution the car releases. These tests meet local government rules. They keep roads safe and air cleaner. Passing these tests is important before selling the car.

Trade-in And Down Payment Considerations

Trade-in and down payment are key parts of buying a car. They can lower the amount you need to borrow. Choosing the right trade-in value and down payment affects your budget. Understanding these can help avoid surprises in your financing process.

Effect On Overall Financing

A higher down payment lowers your monthly car payments. It also reduces the total interest paid on the loan. A good trade-in value can act like a down payment. Both reduce the loan amount you need from the lender. This makes financing easier and cheaper. Low down payments or poor trade-in values increase your loan size. Bigger loans often mean higher monthly payments. This can stretch your budget and increase loan costs.

Potential Hidden Costs

Trade-ins may have fees like inspection or reconditioning costs. Dealers might offer less than your car’s true value. This lowers your trade-in benefit. Down payments usually have no extra fees. But some loans require a minimum amount. Failing to meet this can lead to extra charges. Watch for taxes on the down payment. These can add to your upfront costs. Knowing all fees helps plan your finances better.

Avoiding Unexpected Charges

Unexpected charges can turn a simple car purchase into a costly surprise. Knowing how to avoid these fees saves money and stress. Stay alert and prepared at every step of the buying process. Understanding common fees and your rights helps you spot unnecessary costs quickly.

Negotiation Tips

Always ask for a breakdown of all fees before agreeing to buy. Some fees are negotiable, like dealer preparation or document fees. Politely challenge any charges that seem high or unclear. Use research to support your negotiation. Compare prices and fees at different dealerships. Don’t be afraid to walk away if the deal feels unfair.

Reviewing The Contract Carefully

Read every line of the contract slowly. Check that all fees match what was agreed upon. Watch for hidden fees or added services you did not request. Confirm the total price before signing. Ask questions about anything unclear. Keep a copy of the contract for your records. This step protects you from unexpected costs later.

Frequently Asked Questions

What Fees Are Included When Buying A New Car?

When buying a new car, fees include sales tax, registration, documentation, dealer fees, and sometimes destination charges. These fees vary by state and dealer, so always check the invoice and ask for a fee breakdown before purchasing.

How Much Are Dealer Fees When Purchasing A Car?

Dealer fees can range from $100 to $500 or more. They cover processing paperwork and handling the sale. Always ask the dealer for a detailed list of fees to avoid surprises and negotiate if possible.

Are Sales Tax And Registration Fees Mandatory?

Yes, sales tax and registration fees are mandatory. Sales tax depends on your state’s rate and the car price. Registration fees cover the vehicle’s legal use on roads and vary by state and vehicle type.

Can I Negotiate Fees When Buying A Car?

Yes, some fees like dealer fees and documentation fees may be negotiable. Always ask the dealer if they can reduce or waive fees. Negotiating can save you money but be polite and informed.

Conclusion

Buying a car involves more than just the sticker price. You will face several fees like taxes, registration, and dealer charges. These costs add up quickly and affect your budget. Knowing these fees helps you plan better and avoid surprises.

Take time to ask questions and read all documents carefully. This way, you pay only what is fair. Understanding fees makes the car buying process smoother and less stressful. Keep these points in mind for a smart purchase.