Are you wondering whether now is the right time to buy a car or if you should wait? Making this decision can feel overwhelming.

Cars are a big investment, and you want to get the best deal without rushing into a choice you might regret. What if you buy now and prices drop? Or what if you wait and miss out on a great offer?

You’ll discover clear signs that tell you when it’s smart to buy and when patience could save you money. Keep reading to take control of your car buying decision and feel confident about your next move.

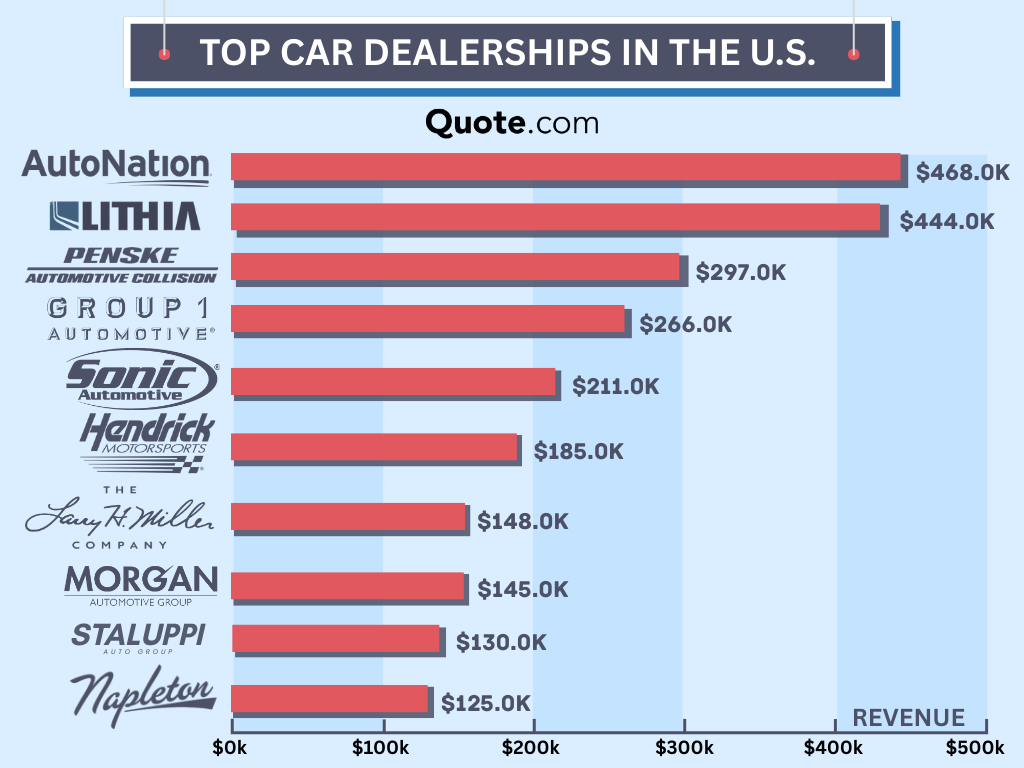

Credit: www.quote.com

Current Market Trends

The car market is changing fast. Prices, availability, and demand are shifting. Understanding these trends helps you decide the best time to buy. The following points explain the current market situation clearly.

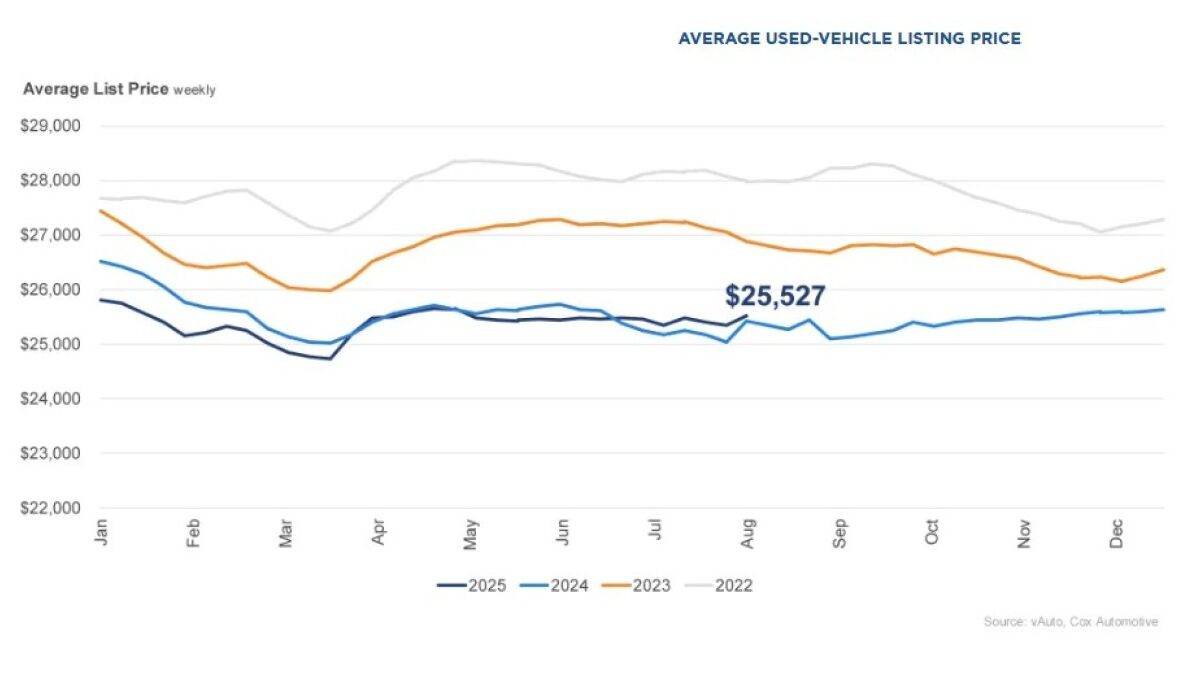

New Vs Used Car Prices

New car prices have risen steadily. Manufacturers face higher costs and pass them to buyers. Used cars also cost more than before. People want affordable options, so demand for used cars stays high. This keeps prices up even for older models.

Inventory Levels

Car dealerships have fewer cars available. Low inventory means less choice for buyers. It also pushes prices higher. Some popular models sell quickly and go out of stock. Buyers might wait longer or pay more due to limited supply.

Impact Of Supply Chain Issues

Supply chain problems disrupt car production. Parts and materials are harder to get. This slows factory output and reduces new car stock. Delays affect delivery times and price stability. The market feels the strain from these ongoing issues.

Credit: www.kbb.com

Financial Factors To Consider

Financial factors play a big role in deciding whether to buy a car now or wait. Understanding these details helps save money and avoid surprises. This section breaks down key money matters to think about before making a choice.

Interest Rates And Financing Options

Interest rates affect the total cost of your car loan. Lower rates mean you pay less over time. Watch for changes in rates from banks and lenders.

Financing options vary. Some dealers offer special loans or zero-percent financing. Compare offers carefully. Choose the plan with the best terms for your budget.

Incentives And Discounts

Car makers often provide incentives to boost sales. These may include cash rebates, reduced interest rates, or free maintenance. Discounts can lower the car’s price significantly.

Check for seasonal promotions or clearance sales. These deals can change monthly or quarterly. Timing your purchase with these offers saves money.

Depreciation And Resale Value

Cars lose value quickly after purchase. Some models hold value better than others. Research depreciation rates before buying.

Higher resale value means less loss when selling or trading in later. This factor impacts your long-term cost of ownership. Choose vehicles known for strong resale prices.

Seasonal Buying Patterns

Seasonal buying patterns affect car prices and availability. Knowing these trends helps you decide when to buy. Prices often drop during certain months. Dealers may offer better deals during holidays. Understanding these patterns can save you money and stress.

Best Months To Purchase

The end of the year is often the best time to buy a car. Dealers want to clear old stock before new models arrive. October, November, and December usually have lower prices. January and February can also have good deals. Few people shop during these months, so sellers compete more.

Holiday Sales And Promotions

Car dealers offer special discounts during holidays. Memorial Day, Fourth of July, and Labor Day often have sales events. Black Friday and year-end holidays also bring good promotions. These sales include cash rebates and low financing rates. Holiday deals can make buying a car cheaper and easier.

Credit: www.theautopian.com

Personal Readiness

Deciding to buy a car depends a lot on your personal readiness. This means thinking about your money situation, your need for a car, and your plans for keeping it. Understanding these points helps you make a smart choice.

Budget And Affordability

Knowing your budget is key before buying a car. Check your income and monthly expenses. Can you afford the car payment and other costs? Think about insurance, fuel, and maintenance too. Stick to a price that fits your budget well. Avoid borrowing too much money. A car should not cause financial stress.

Urgency Of Need

How soon do you need a car? Some people need a car right away for work or family. Others can wait. If your current transport works fine, waiting might save money. New car deals or sales may come later. Urgency changes your timing and choice.

Long-term Ownership Plans

Plan how long you want to keep the car. Do you want it for many years or just a short time? Long-term ownership means thinking about durability and costs over time. Short-term use might favor cheaper or used cars. Your plans affect the type of car to buy.

Expert Buying Strategies

Buying a car can feel confusing. Prices change. Deals appear and disappear. Expert buying strategies help you make smart choices. They save money and reduce stress. Follow these tips to buy with confidence.

Negotiation Tips

Start by researching car prices online. Know the average cost for the model you want. Be polite but firm when talking to the dealer. Ask for discounts or extras like free maintenance. Don’t accept the first offer. Take your time. Be ready to walk away if the price is too high. This shows you mean business.

Timing Your Purchase

Car prices often drop at the end of the month or year. Dealers try to meet sales goals during these times. Holidays and special sales events can offer good deals. Avoid buying a new model right after its release. Older models usually cost less. Keep an eye on interest rates too. Lower rates can save you money on loans.

Alternative Buying Options

Consider buying a certified pre-owned car. These cars are inspected and come with warranties. Leasing is another option if you want lower monthly payments. Private sellers might offer better prices but check the car carefully. Online car marketplaces provide many choices. Compare all options before deciding. This helps you find the best deal for your budget.

Frequently Asked Questions

Is Now The Best Time To Buy A New Car?

Yes, if interest rates are low and inventory is high, now is a good time. Prices may be more competitive, and you can find good deals on new models.

Should I Wait For Better Car Prices?

Waiting can help if market prices are high or supply is low. Watch for seasonal sales and economic changes that might lower costs.

How Do Interest Rates Affect Car Buying?

Lower interest rates reduce monthly payments and overall loan cost. Higher rates increase your expenses, so timing your purchase with rates matters.

Are Used Cars A Better Option Right Now?

Used cars often cost less and depreciate slower. If new car prices are high, a certified used car may offer better value.

Conclusion

Deciding to buy a car now or wait depends on your needs and budget. Prices and interest rates can change soon. Sometimes, waiting brings better deals, but you might miss current offers. Think about how much you need a car today.

Research and compare prices before making a choice. Stay informed about market trends and sales events. Remember, the right time varies for each person. Choose what feels best for your situation and wallet.