Have you ever wondered how much you should really spend on a car based on your yearly salary? It’s easy to get caught up in flashy models and tempting deals, but making the wrong choice can hurt your finances in the long run.

What if there was a simple way to figure out the perfect price range for your next car—one that fits your income and keeps your budget healthy? Keep reading, because understanding this can save you money, reduce stress, and help you make smarter decisions.

Your wallet will thank you.

Car Budget Basics

Setting a car budget is key before buying a vehicle. It helps avoid financial stress later. Knowing how much to spend keeps your finances safe and balanced.

Your car budget should match your income and lifestyle. Cars are big purchases. A thoughtful budget makes sure you pay only what you can afford.

Linking Car Cost To Income

Your yearly salary guides your car budget. A common idea is to spend a part of your income on a car. This keeps your payments manageable. A car that costs too much can hurt your savings and bills.

Many experts say your car should cost about half your yearly salary. For example, if you earn $40,000, consider a car around $20,000. This helps balance your money between needs and wants.

Common Budgeting Rules

Simple rules help choose the right car price. One rule is the 20/4/10 plan. Spend 20% for a down payment, finance for 4 years max, and keep monthly costs under 10% of income.

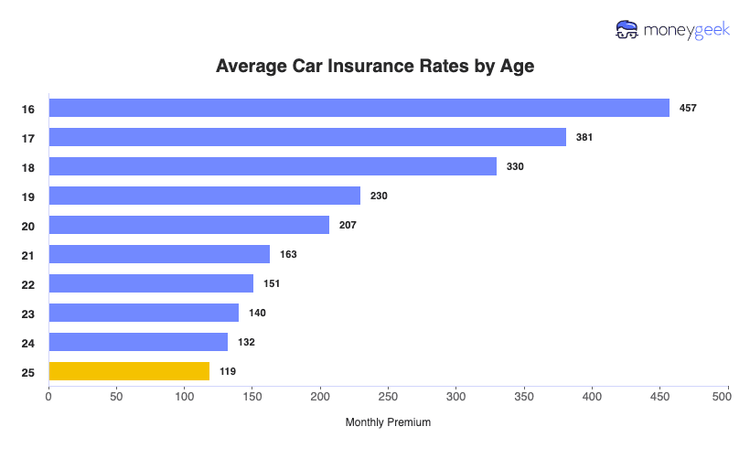

Another rule says your total car expenses should not pass 15% of your monthly take-home pay. Expenses include loan payments, insurance, and fuel. These rules protect your money and reduce debt risk.

Credit: www.moneygeek.com

Factors Affecting Car Affordability

Deciding how much to spend on a car depends on many factors. Your yearly salary is a starting point, but it is not the only thing to consider. Other financial responsibilities and goals affect how much car you can afford. Understanding these factors helps you make smarter choices. It keeps your budget balanced and your finances safe.

Monthly Expenses And Debt

Monthly expenses take up a big part of your income. Rent, bills, groceries, and loan payments reduce how much money you have left. Debt from credit cards or student loans also limits your budget. Buying a car means adding monthly payments for loans or insurance. You must ensure these new costs do not cause financial stress. A car payment should not make it hard to pay your bills.

Other Financial Goals

Car buying is not the only goal for your money. Saving for emergencies, education, or a home is important too. You might want to invest or plan for retirement. Spending too much on a car can slow down these goals. Think about your future plans before deciding on a car price. Balance your car costs with other priorities to stay financially healthy.

Choosing Between New And Used Cars

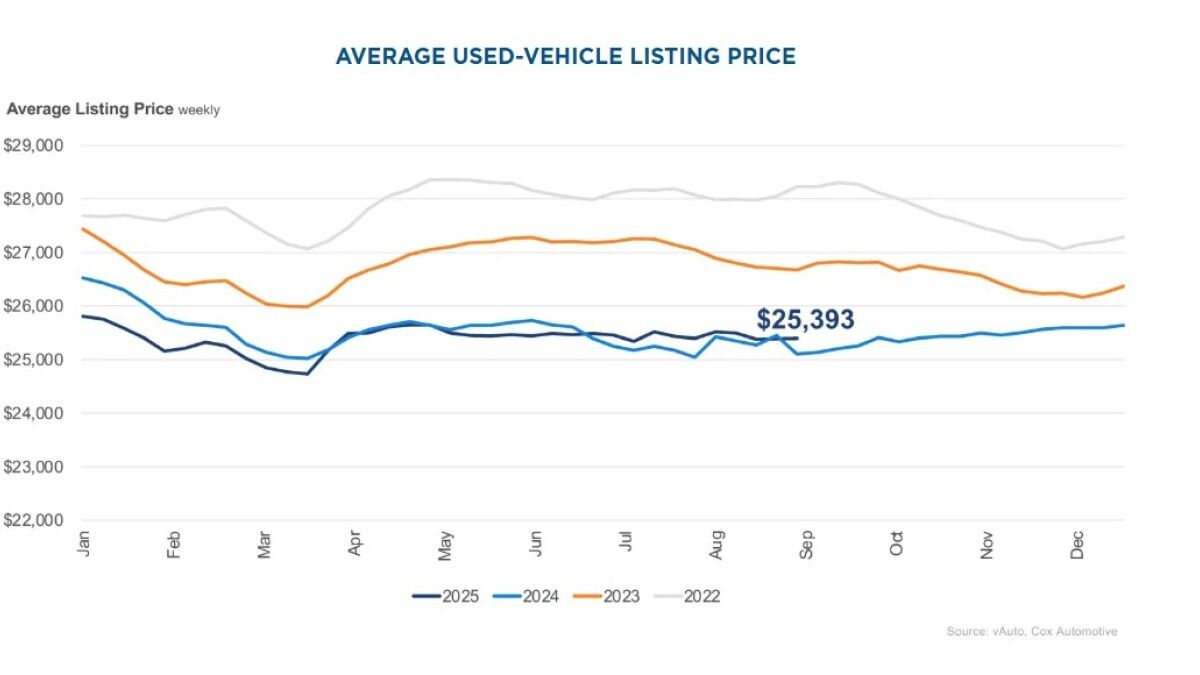

Choosing between new and used cars affects how much you spend on a car compared to your yearly salary. Both options have different costs and benefits. Understanding these helps you make a smart choice that fits your budget and needs.

Pros And Cons Of New Cars

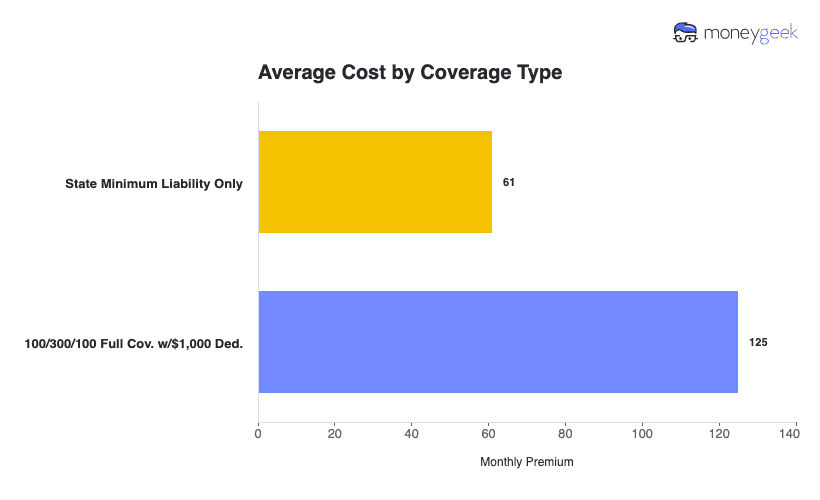

New cars come with the latest features and full warranty. They need less maintenance early on. The fuel efficiency is often better. New cars hold value longer at first but lose value quickly in the first years. They cost more upfront and may increase your monthly payments. Insurance for new cars is usually higher than for used cars.

Benefits Of Used Cars

Used cars cost less than new ones. You get more car for your money. Depreciation is slower, so the car holds its value better. Insurance costs tend to be lower. Used cars may have some wear and tear. You might spend more on repairs and maintenance. Choosing a certified used car reduces risks and offers some warranty.

Credit: www.kbb.com

Financing Options And Impacts

Choosing the right way to pay for your car affects your budget and future finances. Understanding financing options helps you pick a smart choice. You can buy a car with a loan or lease it. Each option has different costs and benefits. Knowing these will guide you to a better decision.

Loans And Interest Rates

Car loans let you pay for the car over time. You borrow money from a bank or lender. Interest is the extra cost for borrowing money. Lower interest rates mean paying less overall. Your credit score often affects the interest rate you get. Longer loan terms lower monthly payments but increase total interest. Short loans cost more each month but save money on interest. Always check the interest rate before signing any loan agreement.

Leasing Vs Buying

Leasing means renting the car for a set time. You pay monthly fees but do not own the car. Leasing often has lower monthly payments than loans. You must return the car at the end of the lease. Buying means you own the car after paying in full. Buying costs more monthly but builds equity in the car. Leasing has mileage limits and fees for damage. Buying allows unlimited use and no return requirements. Decide what fits your lifestyle and budget better.

Calculating Your Ideal Car Price

Knowing how much to spend on a car is not always easy. Your yearly salary gives a useful guide. It helps set a limit on what you can afford. Calculating the ideal car price means balancing needs and budget. This keeps your finances safe and stress low.

Let’s explore simple ways to find the right car price. These methods help avoid overspending and keep costs clear.

Using Salary Multiples

One way to decide is by using salary multiples. This means multiplying your yearly income by a set number. Many experts suggest spending about 20% to 30% of your yearly salary on a car. For example, if you earn $50,000 a year, a car costing $10,000 to $15,000 fits well.

This rule stops you from choosing a car that is too expensive. It helps keep your monthly payments manageable. Always think about your whole salary, not just what you take home after taxes.

Budgeting For Total Ownership Costs

Car price is just the start of costs. Ownership includes fuel, insurance, maintenance, and repairs. These costs add up quickly and affect your monthly budget. Plan for these before buying a car.

Calculate average yearly expenses for these items. Add them to your car price to get the true cost. This full picture helps you pick a car that fits your salary and lifestyle.

Tips To Save On Car Purchases

Saving money on a car purchase helps keep your budget balanced. Smart buying can reduce costs and stress. Use clear strategies to get the best deal possible. These tips focus on practical ways to lower car expenses.

Negotiation Strategies

Start by researching the car’s market price. Knowing the average cost helps you spot a fair offer. Stay calm and confident during talks. Don’t accept the first price given. Ask for discounts or extras like free maintenance. Be ready to walk away if the deal feels bad. Sellers often improve offers to keep buyers interested.

Timing Your Purchase

Car prices change with the calendar. End of the month or year often brings lower prices. Dealers want to meet sales goals before deadlines. Shopping during weekdays can mean less competition. New models arriving may lower prices on older ones. Patience pays off by waiting for these times.

Avoiding Common Budgeting Mistakes

Budgeting for a car can be tricky. Many people make mistakes that hurt their finances. Avoiding common budgeting errors helps keep your money safe. It also ensures your car choice fits your income. Careful planning stops stress and surprise costs later.

Ignoring Long-term Expenses

Buying a car is more than just the price tag. You must think about fuel, insurance, and repairs. These costs add up over time. Missing these expenses can break your budget. Plan for regular maintenance and unexpected repairs. This keeps your finances steady and avoids debt.

Overestimating Disposable Income

Disposable income is what you have left after bills. Many people think they have more money than they do. This leads to spending too much on a car. Be honest about your monthly expenses and savings goals. Use only the true disposable income to decide your car budget.

Credit: www.kbb.com

Frequently Asked Questions

How Much Of My Salary Should I Spend On A Car?

Financial experts recommend spending no more than 15% of your yearly salary on a car. This ensures you can afford other expenses comfortably. Keeping your car budget within this limit helps maintain a balanced financial life without overspending.

Is It Better To Buy Or Lease Based On Salary?

Buying is generally better if you plan to keep the car long-term. Leasing may suit those with a stable, higher salary who prefer lower monthly payments and frequent upgrades. Your decision should consider your income and financial goals.

How Does My Salary Affect Car Loan Approval?

Lenders assess your salary to determine loan eligibility and amount. A higher salary improves your chances of approval and favorable interest rates. Ensure your monthly payments do not exceed 15% of your income for manageable finances.

What Car Price Is Affordable On A Middle-class Income?

On a middle-class salary, aim for cars priced around $20,000 to $30,000. This range keeps your purchase within 15% of your annual income, balancing affordability and quality. Always consider total ownership costs beyond the sticker price.

Conclusion

Choosing a car within your budget keeps finances healthy. Spending too much can cause stress and debt. Aim for a car price that feels right with your salary. Balance your needs and wants carefully. A smart choice leads to comfort and peace of mind.

Remember, a car is a tool, not a status symbol. Keep your future goals in mind when deciding. Drive wisely and enjoy the journey without money worries.