Quick Summary: Generally, your total vehicle expenses (loan payments, insurance, maintenance) should not exceed 15% to 20% of your take-home pay. For the purchase price of the car itself, aim for no more than 30% to 50% of your annual gross income for a reliable, stress-free ownership experience.

How Much Should Your Car Be Compared To Salary: A Simple Guide to Smart Buying

Deciding on a car purchase can feel huge. You want something that lasts, but you also need to pay your rent and eat! It’s a common worry: how much car can I truly afford? Many people feel stressed trying to balance their transportation needs with their budget goals. If you are looking for clear rules instead of complicated math, you are in the right place. We’re going to break down the best guidelines, making sure your car adds convenience without creating financial headaches. Let’s explore the simple ratios that experts use to keep drivers happy and solvent.

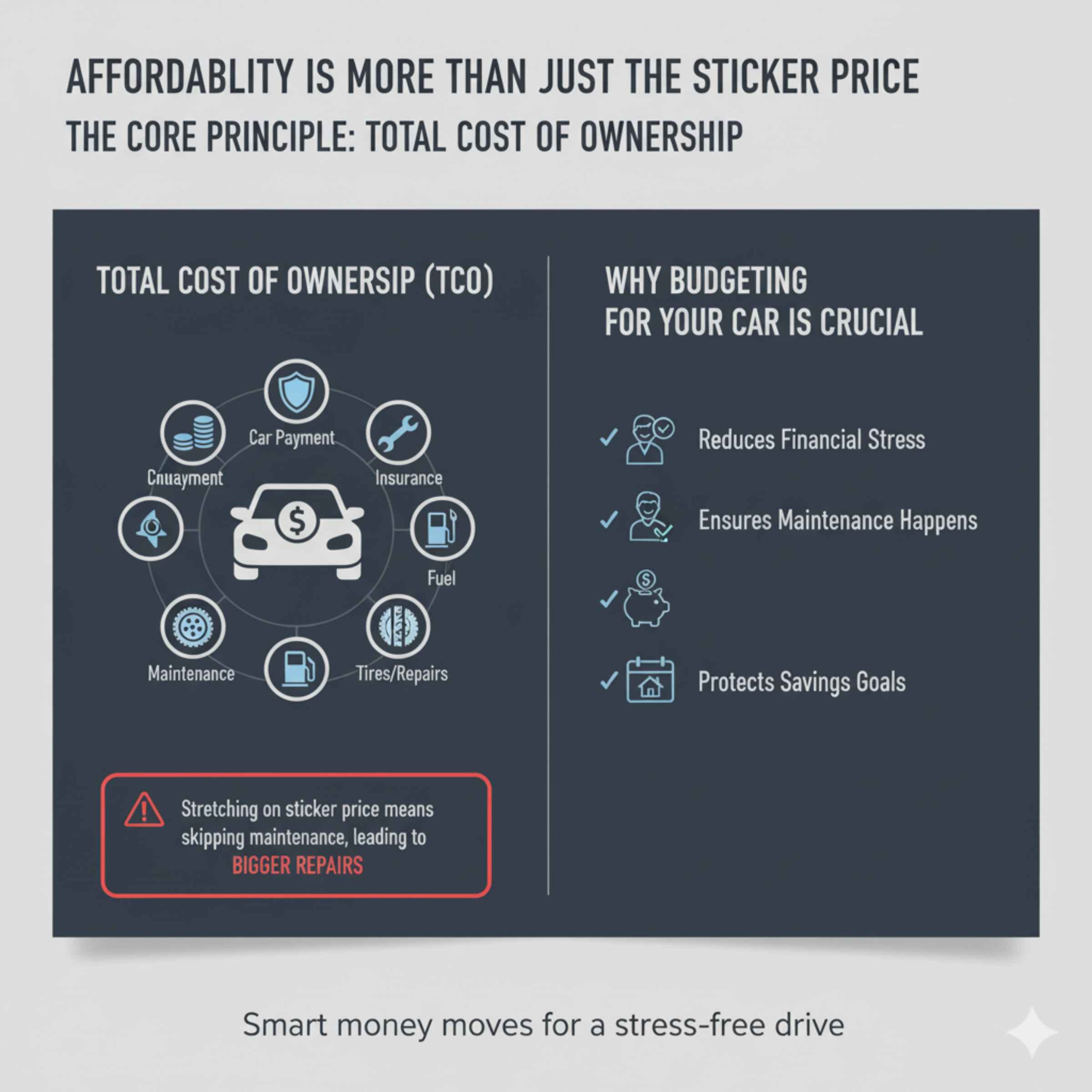

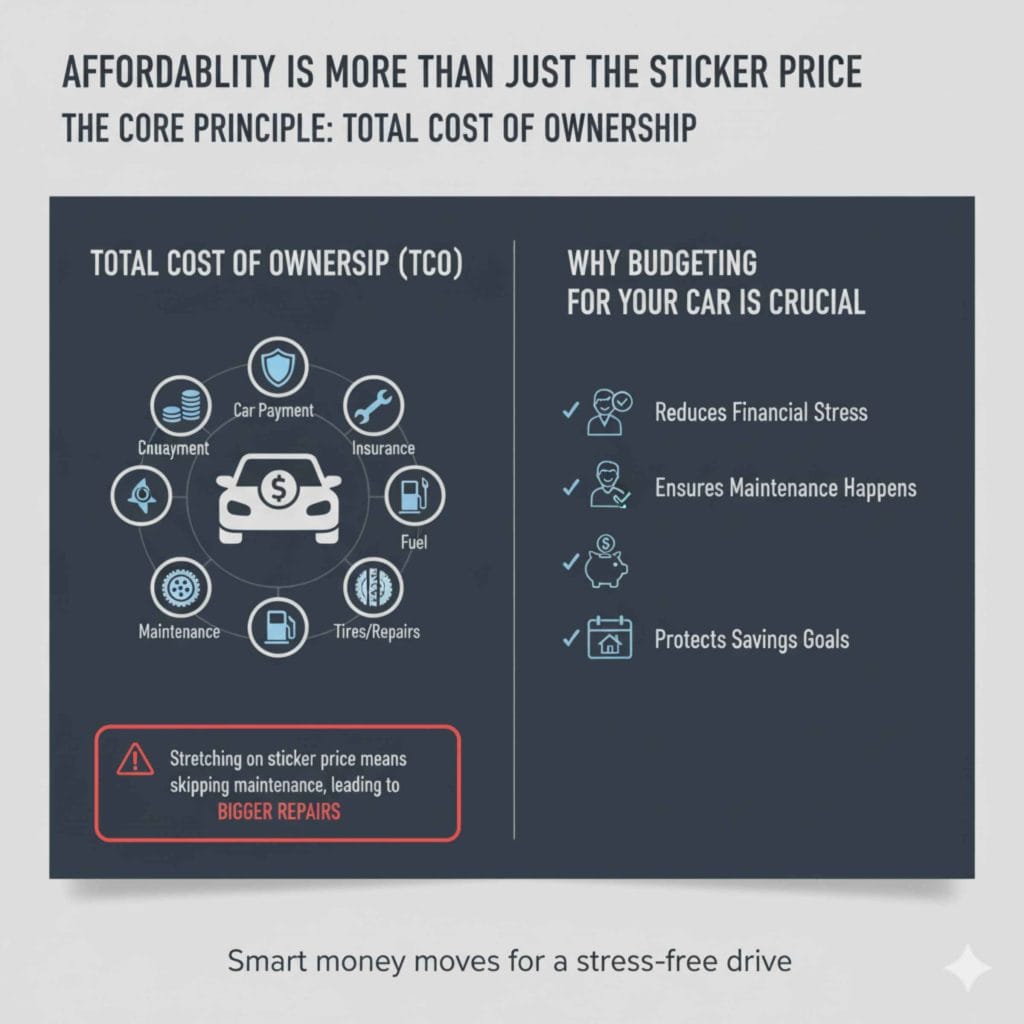

The Core Principle: Affordability is More Than Just the Sticker Price

When talking about affordability, the upfront cost of the car—the sticker price—is just the starting line. As a trusted automotive guide, I want you to think about the Total Cost of Ownership (TCO). This TCO includes everything: the car payment, insurance, gas, and those routine maintenance items we sometimes forget about. Stretching yourself too thin on the purchase price means you might skip necessary oil changes down the road, which leads to bigger, scarier repair bills later.

Why Budgeting for Your Car Is Crucial

A vehicle is a necessity for most people, but it quickly becomes a giant expense if not managed properly. When your car payment is too high, you lose financial flexibility. This is why we follow established financial guidelines rather than just buying what looks good on the lot.

- Reduces Financial Stress: Knowing your ownership costs are covered means fewer sleepless nights when bills arrive.

- Ensures Maintenance Happens: A proper budget allows you to save for regular maintenance (like new tires or brake pads), keeping your car safe and reliable.

- Protects Savings Goals: You still need to save for retirement, emergencies, and maybe a down payment on a house! A costly car eats into those goals quickly.

The Golden Rule: Recommended Car Budget Ratios

Financial experts have developed a few simple rules, often called “ratios,” to help you size up the right vehicle for your income. These aren’t strict laws, but they are fantastic starting points to ensure you remain financially balanced.

Ratio 1: The Total Transportation Cost Rule (The 15% to 20% Rule)

This is perhaps the most important guideline for long-term financial health. It focuses on all the recurring costs associated with driving.

Rule Overview: Your total monthly vehicle expenses (loan payment + insurance + average monthly maintenance/repairs) should ideally be no more than 15% to 20% of your net (take-home) monthly salary.

Let’s look at an example to make this easy. If you take home $4,000 per month:

15% of $4,000 = $600

20% of $4,000 = $800

This means your total monthly car burden should hover between $600 and $800. If you have a low car payment but high insurance or you drive a lot and spend $400 on gas monthly, you must keep the payment low to stay under that $800 ceiling.

Ratio 2: The Purchase Price Rule (The 30% to 50% Rule)

This rule addresses the actual price tag of the vehicle you are considering buying. It is often linked to your annual gross (pre-tax) income.

Rule Overview: The selling price of the car should generally be between 30% and 50% of your total annual gross salary.

For someone making $60,000 a year gross salary:

30% of $60,000 = $18,000 (This is a safe starting point for a reliable used car).

50% of $60,000 = $30,000 (This is the absolute ceiling for a slightly newer purchase).

If you are buying a $35,000 car on a $60,000 salary, you are already over the 50% guideline, and that doesn’t even include the interest you will pay over the loan term!

Factoring in Your Down Payment

If you have a large down payment saved up, you can generally afford a slightly higher purchase price because you are borrowing less money and paying less interest. A strong down payment shifts risk away from you and onto the bank, which is generally a good thing for your budget!

Step-by-Step: Calculating Your Personal Car Budget

You don’t need a fancy calculator. We can walk through this with simple steps. Follow along to find your personalized spending limit.

Step 1: Determine Your Monthly Take-Home Pay (Net Income)

Look at your pay stubs. This is the actual amount deposited into your bank account after taxes, retirement contributions, and health insurance premiums are taken out.

Example: Let’s assume your reliable monthly take-home pay is $4,500.

Step 2: Calculate Your Monthly Transportation Ceiling

Take your net income and apply the 15% to 20% rule.

- Minimum Safe Budget (15%): $4,500 x 0.15 = $675 per month.

- Maximum Stretch Budget (20%): $4,500 x 0.20 = $900 per month.

Your goal is to keep all car costs under $675, but you have room to go up to $900 if absolutely necessary.

Step 3: Estimate Your Fixed Ownership Costs (Non-Payment Items)

Before you even look at a car payment, you need to set aside money for the essentials that aren’t the loan itself.

Insurance Estimate

Insurance costs vary wildly based on age, location, vehicle type, and driving history. A good rule of thumb for a financed vehicle is to budget $120–$200 per month. Always get real quotes before you buy!

Maintenance & Fuel Fund Estimate

This is often missed! You need a savings pot for oil changes, tires, fluids, and unexpected repairs. For a newer car, aim for $75 per month. For an older car, you might need $150 or more. Check reliable sources like the U.S. Department of Transportation’s Federal Highway Administration data for regional gas cost averages.

Let’s use mid-range estimates for our example budget:

- Estimated Monthly Insurance: $150

- Estimated Maintenance Fund: $100

- Total Fixed Costs: $250 per month

Step 4: Determine Your Maximum Affordable Car Payment

Subtract your fixed costs from your Monthly Transportation Ceiling.

Using the $675 Safe Budget: $675 (Ceiling) – $250 (Fixed Costs) = $425 Maximum Monthly Payment.

Using the $900 Stretch Budget: $900 (Ceiling) – $250 (Fixed Costs) = $650 Maximum Monthly Payment.

Knowing you can afford a maximum payment of $425 to $650 per month now allows you to shop for vehicles much more effectively.

Calculating Purchase Price Based on Payment and Loan Terms

Once you know your maximum monthly payment, you can work backward to see what purchase price fits that payment, keeping in mind the loan term (length) and the interest rate (APR).

Impact of Loan Length and Interest Rate

Longer loans equal lower monthly payments, but you pay significantly more interest over time. Shorter loans mean higher payments but lower total interest paid.

We can look at the general bracket for what a payment buys you, assuming current average interest rates (which fluctuate, so always verify with lenders).

| Loan Term (Years) | If max payment is $500/mo | If max payment is $650/mo |

|---|---|---|

| 4 Years (48 months) | Up to ~$21,000 | Up to ~$27,300 |

| 5 Years (60 months) | Up to ~$23,500 | Up to ~$30,500 |

| 6 Years (72 months) | Up to ~$25,000 | Up to ~$32,500 |

Important Note: These figures are estimates based on average market conditions and do not include taxes, title, or registration fees, which must be added to the purchase price.

This is why experts strongly recommend keeping payments short (under 60 months) if possible, even if it means buying a cheaper car today. It saves you thousands in interest and gets you out of debt faster!

Beyond the Numbers: Qualitative Affordability Factors

While math controls your budget, other non-numeric factors influence how “affordable” a car truly is. These are often related to reliability and usage.

Factor 1: New vs. Used Vehicle Depreciation

New cars lose value incredibly fast the second you drive them off the lot. This massive loss in value is called depreciation. Buying a car that is just 2-3 years old allows someone else to absorb that huge initial depreciation hit, giving you a much better value proposition versus your salary.

Factor 2: Reliability and Maintenance History

A $10,000 used car that constantly breaks down might cost you far more than a $15,000 used car known for its reliability. This leads directly to my next major point: checking the vehicle history. You should always use resources like the National Motor Vehicle Title Information System (NMVTIS) website, run by the U.S. Department of Justice, to check vehicle titles before any major purchase. Reliability directly impacts your monthly maintenance budget.

Factor 3: Your Specific Driving Needs

How much do you drive? If you commute 100 miles daily, you need a cheaper, more fuel-efficient car (even if your budget allows for a gas-guzzler). Higher mileage means more frequent oil changes, sooner tire replacement, and more wear and tear—all of which eat into that 20% budget ceiling.

Breaking Down Total Car Costs: What to Account For

To help you build an accurate TCO, here is a detailed look at every component that makes up your monthly car expense. Understanding this helps you maximize your budget.

Monthly Expenses (The Recurring Costs)

- Car Payment (Principal + Interest): The largest, most controllable variable.

- Car Insurance Premiums: Required if you finance; crucial even if driving an older, owned car.

- Fuel Costs: Highly variable based on local prices and annual mileage.

- Tolls and Parking Fees: If you work in a city or use toll roads regularly, these must be budgeted monthly.

Annual/Irregular Expenses (The Savings Fund Needs)

- Registration and Licensing Fees (Varies by state).

- Annual or Bi-Annual Inspection/Emissions Testing Fees.

- Tire Replacement (Savings should be set aside monthly).

- Major Maintenance (e.g., Timing belt, brake servicing—savings should be set aside monthly).

- Unexpected Repairs (The emergency buffer).

Comparing Affordability Across Different Ownership Scenarios

The standard rules work best, but context matters. How you pay for the car changes the calculus.

Scenario A: Paying Cash (No Loan)

If you pay cash, the 15%–20% rule changes slightly. You are free from the car payment, which is fantastic! However, you should still use that “missing” payment amount as a dedicated savings fund for maintenance, upgrades, and saving up for your next car purchase.

If you save $600/month (the money you would have paid), in one year you have $7,200 saved for maintenance or a down payment on a newer vehicle. This scenario provides the most financial breathing room.

Scenario B: Financing Through a Dealership (Long-Term Loan)

This is where most people get into trouble. Dealers often push for 72 or 84-month loans to make the monthly payment look small. While this keeps your payment low, it leaves you “underwater” (owing more than the car is worth) for years, and you pay substantially more interest.

My advice as your guide: Resist long loans! A shorter loan term forces you to buy a cheaper car initially, but it leads to owning a reliable asset outright sooner.

Scenario C: Leasing

Leasing is essentially long-term renting. You are constantly paying, and you build zero equity. While monthly payments can be low, you must stick strictly to mileage limits and factor in any potential “wear and tear” fees at the end. It is often the least financially sound long-term strategy for drivers who want to build wealth.

Tools to Help You Estimate Your True Costs

While I focus on practical, hands-on advice, using reliable online tools can confirm your budget math. Many independent financial planning sites offer estimators based on current national averages. Be cautious about manufacturer websites that aim to maximize loan length.

For reliable, objective cost data, consulting resources like Consumer Reports or government energy efficiency sites, which track real-world fuel economy and reliability scores, is highly recommended before committing to a specific model.

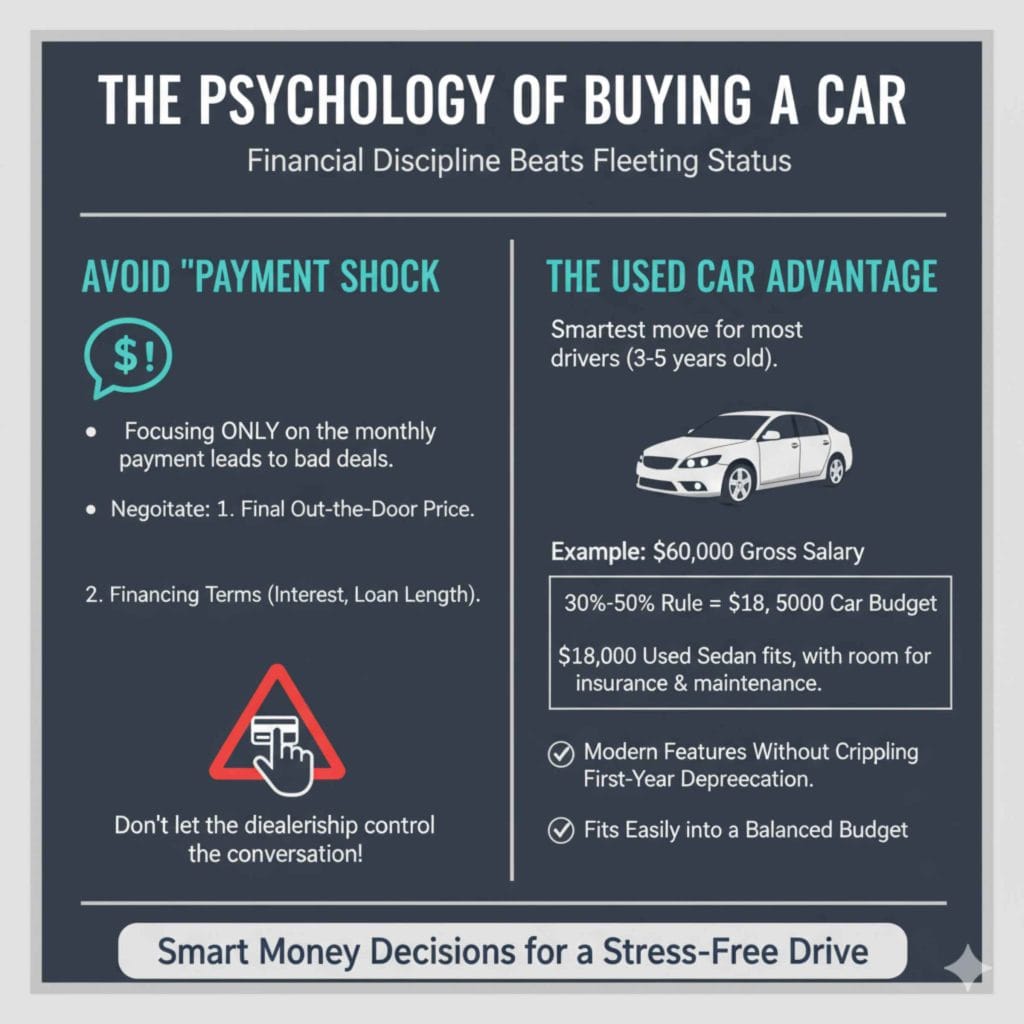

The Psychology of Buying a Car

We can’t ignore the emotion involved. A car often represents freedom and status. However, financial discipline beats fleeting status every time.

Avoid “Payment Shock”

The term “payment shock” happens when you focus only on the monthly number quoted by the salesperson and ignore the total price, the interest rate, and the loan term when negotiating. Always negotiate the final out-the-door price first, then discuss financing. Never let the dealership turn the conversation into only discussing the monthly payment.

The Used Car Advantage

For most drivers sticking to the 30%–50% gross income rule, a reliable used vehicle (3 to 5 years old) is the smartest move. You get modern features without the crippling first-year depreciation. A well-maintained sedan that costs $18,000 fits easily into a $60,000 gross salary budget, leaving plenty of room for insurance and maintenance.

FAQ: Essential Car Budget Questions Answered

Q1: Is 20% of my take-home pay too low for a car budget?

A: For maximizing your savings and long-term financial goals, 15% is actually the safer target. 20% is the maximum recommended ceiling. If you live in an area with very high insurance rates or anticipate high fuel costs, aim closer to 15%.

Q2: Does a large down payment change the salary ratio rule?

A: A large down payment is excellent because it lowers your loan amount and the interest you pay. While you can afford a slightly higher purchase price because you borrowed less, the Total Transportation Cost Rule (15%–20% of net pay) should still apply to your monthly payment plus all other vehicle expenses.

Q3: What if I have significant student loan debt?

A: If you have high-interest debt (like credit cards or large student loans), you should aggressively lower your transportation budget. Try to keep your total car costs closer to 10%–12% of your net pay while you pay down that other debt first. Debt reduction saves you more money long-term than a fancy car payment ever will.

Q4: My income is low, but I need a reliable car for work. What now?

A: Focus on proven, reliable “boring” cars known for low maintenance costs (think certain Japanese sedans or older domestic models with great parts availability). Look at the lower end of the purchase price rule (30% of gross income or less) and prioritize paying cash or buying a very short-term loan (36 months maximum) to avoid high interest.

Q5: Should I include gas money in the 20% budget calculation?

A: Yes, absolutely! The 15%–20% rule is for Total Transportation Cost. This includes the payment, insurance, fuel, and maintenance. If you don’t account for gas, your car payment might seem affordable until you realize you have no money left for groceries!

Conclusion: Driving Confidence Into Your Purchase

Understanding how much car your salary can comfortably support isn’t about settling—it’s about smart planning. By sticking closely to the guidelines, especially the Total Transportation Cost Rule (15%–20% of net pay)**, you ensure your vehicle remains a functional tool rather than a financial anchor. Calculate your maximum monthly dollar amount first (Step 2), account for fixed costs like insurance (Step 3), and then shop for a vehicle whose loan payment fits neatly into the remainder. This balanced approach, focusing on affordability over aspiration, will give