The cost of a reliable car should generally fit comfortably within a budget where monthly payments (if financing) and ownership expenses consume no more than 15% to 20% of your take-home pay, ensuring financial peace without sacrificing essential needs.

Figuring out what car you can truly afford causes lots of stress. It feels like guessing a secret number! You want reliability, but you do not want that car payment to control your life. You’ve probably heard different rules, and none of them seem to fit your situation perfectly. That is totally normal. I’m Dustin Hall, and together, we’ll ditch the confusing math. We’ll use simple steps to find the “sweet spot” for your budget. This guide will show you exactly how to determine a safe and smart price for your next vehicle.

The Golden Rule: Your Budget Comes Before the Sticker Price

Before you even look at a shiny new sedan or a great used truck, you must look inward—at your bank account. A car is a tool, not a lifestyle statement, especially when first starting out. The goal is for the car to never cause you financial worry.

Forget what the car salesperson suggests. Forget what your neighbor drives. We focus on what keeps your life easy and your savings account safe. The most common mistake people make is focusing only on the monthly payment they see in the showroom.

The 20/4/10 Rule: A Quick Financial Snapshot

For decades, financial experts have used budget percentages to keep big purchases manageable. While this rule often applies to new car loans, it’s a fantastic starting point for anyone buying any vehicle, new or used:

- 20% Down Payment: Put down at least 20% of the purchase price. This reduces your loan amount immediately and shows the lender you are serious.

- 4-Year Loan Term (Maximum): Try to keep your total loan period to four years (48 months). Shorter terms mean less interest paid over time.

- 10% Total Monthly Expense Cap: Your total monthly car expenses (payment, full insurance, gas) should not exceed 10% of your gross monthly income. (Note: Some modern calculators suggest stretching this slightly to 15% if your down payment is large, but 10% is the safest starting point).

- (For a more aggressive safety approach, many personal finance experts recommend keeping the total cost of the vehicle itself—loans plus cash—below 35% to 50% of your annual salary).

Step 1: Know Your True Income (The Foundation)

You cannot build a house on sand. Similarly, you cannot build a car budget without truly knowing how much money actually hits your bank account. This is called your “Net Income” or “Take-Home Pay.”

If you are paid weekly or bi-weekly, multiplying your check by four or two might overestimate your budget slightly due to months with five paychecks. It is best to look at your last three pay stubs and calculate the average amount deposited.

Why Gross Income Doesn’t Matter for Spending

Gross income is your pay before taxes, retirement contributions, and insurance deductions. If you base your car budget on gross income, you are planning to spend money you legally owe someone else (the government, your 401k provider). Always use the money that is actually yours.

Action Item: Grab your last few pay stubs and average the “Net Deposit Amount.” This is your Magic Number for budgeting.

Step 2: Tally Up All Ownership Costs (The Hidden Expenses)

The sticker price is just the beginning. This is where many beginners get tripped up. Think of buying a car like adopting a pet—the initial adoption fee is small compared to years of food, vet visits, and grooming! We need to budget for the “pet maintenance.”

These costs are non-negotiable and must come out of your monthly income before you even calculate the loan payment.

The Essential Ownership Cost Checklist

Use this list to calculate your mandatory minimum monthly cost:

- Insurance: Call your agent before you buy. Get quotes for the specific make and model you are considering. Younger drivers or those with high-value cars will pay much more than older drivers with standard sedans.

- Fuel: How much gasoline do you use weekly? Multiply that by 4.33 (the average number of weeks in a month).

- Taxes and Registration: Many states require you to pay annual fees. Divide that total annual amount by 12 to get your monthly set-aside amount. Check your state’s Department of Motor Vehicles website for local rates, such as those in California or Texas.

- Maintenance Fund: This is crucial! Even if you buy a brand-new car under warranty, repairs happen. Set aside a small virtual envelope every month for future tires, oil changes, or that unexpected belt replacement. A safe starting point is $75–$150 per month, depending on the age of the car.

Once you add those four items up, you have your “Fixed Monthly Ownership Cost.”

Step 3: Determining Your Maximum Affordable Car Price

Now we combine your income with your fixed costs to find the safe spending limit.

The 15% Rule for Total Outflow

We will aim to keep all transportation costs (loan + ownership) under 15% of your net (take-home) income. This leaves plenty of room for savings, emergencies, and other life events.

Example Calculation:

Let’s say your average monthly take-home pay (Net Income) is $3,500.

Maximum Total Transportation Budget: $$3,500 times 0.15 = $525$ per month.

Now, subtract your Fixed Ownership Costs calculated in Step 2. Let’s assume your required insurance, gas, and maintenance set-aside (before any loan) is $175 per month.

Maximum Loan Payment Budget: $$525 text{ (Total Budget)} – $175 text{ (Fixed Costs)} = $350$ per month.

Your absolute maximum monthly car payment you can safely afford is $350.

Translating Payment into Purchase Price

This is where loan term and interest rate come in. A higher interest rate or a longer loan term means more of your $350 goes to the bank, leaving less for the actual car price. We need to use an estimate, but remember, you should always ask your lender/bank for a precise amortization table.

For simplicity (and safety), let’s assume a typical used-car loan scenario:

- Interest Rate (APR): 7%

- Loan Term: 60 months (5 years) — Note: We are using 5 years here just to show the price impact, but try to stick to 4 years maximum as per the 20/4/10 rule.

Using a standard auto loan calculator with a $350 monthly payment at 7% APR over 5 years, the total loan principal you can afford is approximately $17,000.

Now, Factor in Your Down Payment! If you saved $4,000 for a down payment, you add that back in:

Maximum Affordable Car Price: $$17,000 text{ (Loan Amount)} + $4,000 text{ (Down Payment)} = $21,000$

In this example, your absolute spending limit for a reliable vehicle that doesn’t derail your budget is around $21,000.

New vs. Used: Where Does the Money Go?https://www.youtube.com/watch?v=wftB6LyWqNE&t=83s&pp=ygUaSG93IE11Y2ggU2hvdWxkIEEgQ2FyIENvc3Q%3D

Understanding the depreciation curve is vital. Depreciation is the loss of value over time, and it’s the single largest expense associated with owning a new car.

The Depreciation Hit Map

The moment a new car leaves the lot, it loses value rapidly. The sweet spot for value retention for the buyer is often two to three years old.

| Vehicle Age | Typical Depreciation Rate (Approximate) | Benefit to Buyer |

|---|---|---|

| New (0 Years) | 20% – 30% in Year 1 | Full warranty, latest tech. You pay the most for the loss. |

| 1–3 Years Old | 15% – 25% Total Loss (Total value loss) | Still modern, previous owner absorbed the biggest financial hit. |

| 5 Years Old | 40% – 50% Total Loss | Significantly lower purchase price, but potentially higher maintenance costs looming. |

If you are aiming for the lowest total cost of ownership, a well-vetted, three-year-old vehicle often represents the best balance of modern safety features and reduced financial risk compared to a brand-new model.

Setting the Benchmark: How Much Should a Car Cost Compared to Your Income?

This is the exact question many people ask when talking to loan officers or friends. While the 15% outflow rule above is excellent for monthly budgeting, here is the big-picture benchmark relating the total price to your annual wages.

As a general, conservative guideline, experts advise that the total cost of your vehicle(s) should not exceed 35% to 50% of your annual gross income.

If you make $60,000 gross per year:

- 35% Maximum: $21,000

- 50% Maximum: $30,000

If you financed the entire purchase at $30,000, that loan would likely be too high to maintain the 15% monthly outflow rule unless your insurance and gas costs are extremely low. This benchmark is simply another way to check if you are overleveraging your entire financial future on one asset.

Pro Tip: If you have high existing debt (student loans, credit cards), lean towards the 35% end of the income comparison spectrum or even lower.

Financing Factors: How Interest Shapes Your Final Price

The interest rate—Annual Percentage Rate (APR)—is gasoline poured onto the fire of your loan. A small difference in APR can mean thousands of dollars over a five-year term.

The Power of a Good Rate

Let’s look at that $17,000 loan principal from our earlier example, but change the interest rate:

| Loan Term | APR | Monthly Payment (for $17,000 borrowed) | Total Interest Paid |

|---|---|---|---|

| 5 Years (60 Months) | 12% | $361.08 | $4,664.80 |

| 5 Years (60 Months) | 6% | $338.95 | $3,337.00 |

| 4 Years (48 Months) | 6% | $411.08 | $2,727.84 |

See how keeping the term short (4 years) saves you significant money in interest, even if the monthly payment is slightly higher? This confirms why short loan terms are essential for smart buying. Always shop around for rates through credit unions or your personal bank before walking into the dealership; they often have better starting offers.

Tools You Need to Budget Smarter

Knowing exactly what you can spend requires using the right calculators. You don’t need a fancy finance degree; you just need reliable tools. I recommend checking resources like the Federal Reserve’s consumer guidance pages to verify loan rate averages applicable to your region.

Here are the essential tools for your research phase:

- Auto Loan Payoff Calculator: Use this to reverse-engineer a price based on your max monthly payment (what we did above).

- Total Cost of Ownership (TCO) Calculators: Websites by reputable sources like Kelley Blue Book (KBB) or Edmunds often allow you to compare the projected 5-year cost of two different models, including fuel, insurance estimates, and depreciation.

- Reputable Pricing Guides: Use KBB or NADA Guides to determine the fair market value of the specific used car you are looking at. This ensures you don’t overpay the dealer.

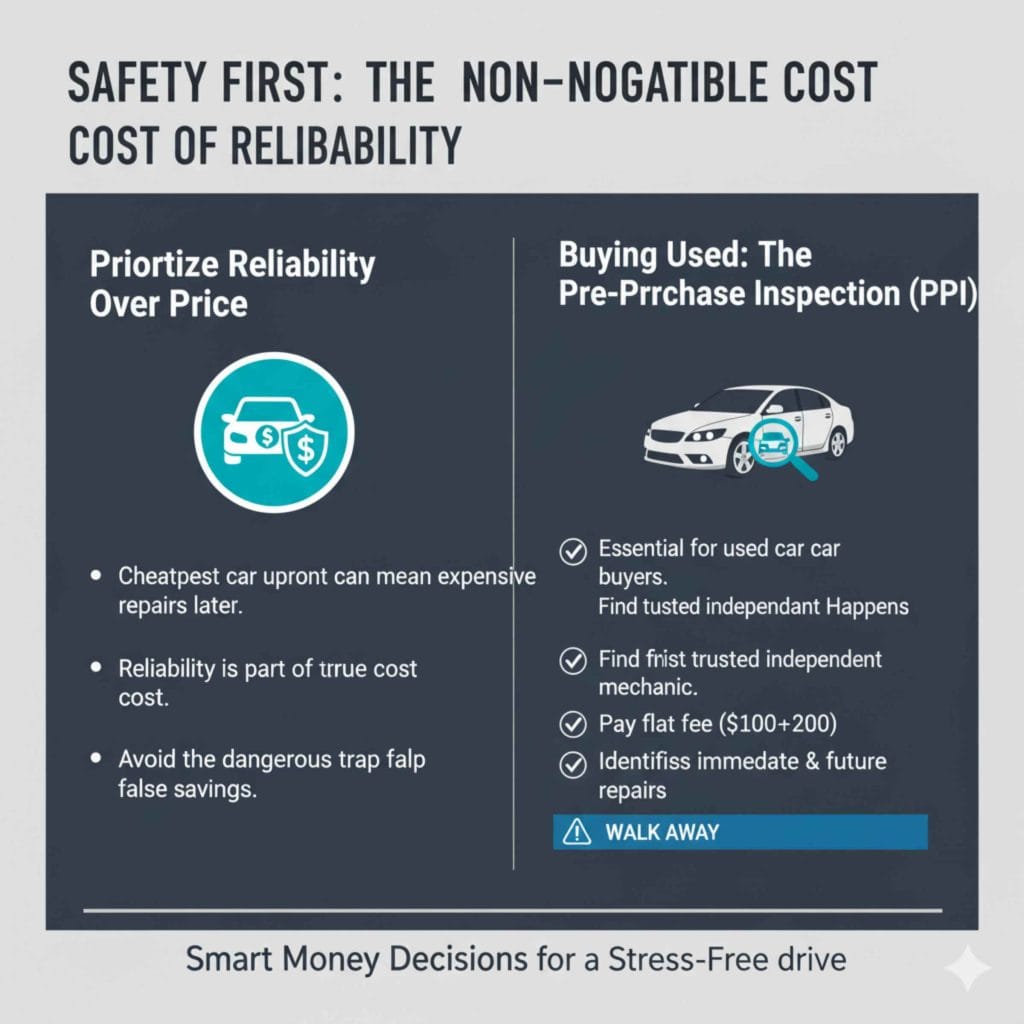

Safety First: The Non-Negotiable Cost of Reliability

When trying to save money, buyers often look at the cheapest cars available. This is a dangerous trap. A car that costs $5,000 today could cost $5,000 in necessary repairs next month, wiping out any savings.

Buying Used: The Pre-Purchase Inspection (PPI)

If you are buying used—and most buyers are—you must factor in the cost of a PPI. This is a small investment that saves huge headaches.

- Find a trusted, independent mechanic whom you choose, not the seller/dealer.

- Pay them a flat fee (usually $100–$200) to inspect the vehicle thoroughly.

- The mechanic will tell you what needs repairing immediately and what needs watching over the next year.

If the PPI shows the brakes need immediate replacement, you add that cost to the purchase price. If that new total pushes you over your 15% budget limit, walk away. Reliability is part of the true cost.

Buyer Profiles: What Drives Your Car Cost?

Your ideal car cost changes dramatically based on where you are in life. Here are three common scenarios to help you benchmark your situation.

Profile A: The Debt-Conscious Saver (Focus on Low Total Cost)

Income: Moderate ($50k–$70k Gross)

Goal: Rapidly build savings/emergency fund. Must keep monthly costs very low.

Guideline: Aim for an annual vehicle expense total (payment + ownership) of 10% of gross income. This often means buying a reliable vehicle outright with cash, or taking a very short loan term (36 months max) on a high-value used car (under $15,000).

Profile B: The Balanced Commuter (Focus on Safety and Predictability)

Income: Average ($75k–$110k Gross)

Goal: Reliability for daily driving; willing to finance a newer, safer vehicle.

Guideline: Stick strictly to the 15% outflow rule. Prioritize a 4-year loan and a moderate deductible insurance plan. You should be comfortable purchasing a vehicle priced in the $20,000 to $35,000 range, depending heavily on your existing cost of living index.

Profile C: The High Earner (Focus on Features and Lower Percentage Burden)

Income: High ($130k+ Gross)

Goal: Desire for newer features, less concern over monthly strain.

Guideline: Even high earners should avoid excessive vehicle debt. While 15% might feel easy to meet, aim to keep the total car price under 50% of gross income. If you can comfortably spend 15% of your income on transport, but your current mortgage/rent is low, you may safely push the vehicle price higher, provided you maintain strong savings elsewhere.

Final Checks Before Signing Anything

You have done the math. You have checked quotes. Before you shake hands, run through this quick checklist. Making a big purchase should feel exciting, not scary, when you are prepared.

- Check the True APR: Does the stated APR match the one you shopped for? If the dealer offers a lower monthly payment but extends the term to 72 months, that is a red flag—you are paying more interest overall.

- Verify Insurance Records: Have the required insurance policy documentation in hand for the specific vehicle. If the premium is higher than your quoted estimate, immediately recalculate the 15% budget.

- Review the Out-the-Door (OTD) Price: This is the final price tag, including all dealer fees, taxes, and title costs. Ensure this final number aligns with the maximum price calculated in Step 3.

- Read the “As-Is” Disclosure (