Quick Summary:

There isn’t a single, fixed number of car insurance comparison sites, but hundreds exist, offering a convenient way for drivers to shop and compare policies. Using a few well-chosen sites can help you find the best coverage and rates without feeling overwhelmed.

Picking car insurance can feel like a puzzle. You want to make sure you’re covered without paying too much. A common question that pops up is, “How many car insurance comparison sites are out there?” It’s a great question because knowing this can help you shop smarter. You might be surprised by how many options you have! Don’t worry, we’ll break it down and show you how to navigate these tools to find exactly what you need.

Why Comparing Car Insurance Matters

Think of your car insurance policy as a safety net. It’s there to protect you financially if something unexpected happens, like an accident. But not all safety nets are created equal, and neither are car insurance policies. Prices and coverage details can vary wildly from one company to another, and even from one policy to another with the same company!

This is where comparison sites come in. They act as a central hub, allowing you to input your details once and see offers from multiple insurers side-by-side. This saves you a ton of time and effort compared to visiting each insurer’s website individually. The goal is simple: find the coverage that fits your needs at a price that fits your budget.

The Landscape of Car Insurance Comparison Sites

So, how many of these comparison sites are there? The honest answer is: a lot! There isn’t one definitive, constantly updated registry for every single comparison site because new ones can pop up, and some smaller ones might become less active. However, we’re talking about hundreds of them operating in various capacities.

These sites can range from:

- Large, well-known platforms that partner with a vast network of insurance companies.

- Smaller, specialized sites that might focus on specific types of coverage or target certain demographics.

- State-specific resources sometimes offered by government agencies or consumer advocacy groups.

The sheer number can seem daunting, but the good news is you don’t need to visit all of them. A strategic approach will get you the best results. We’ll guide you on how to pick the right ones and what to look out for.

Understanding How Car Insurance Comparison Sites Work

These websites are designed to make your life easier. Here’s a simplified look at what happens behind the scenes:

- You Provide Information: You’ll fill out a form with details about yourself (age, driving history, location), your vehicle (make, model, year, safety features), and the type of coverage you’re looking for (liability, collision, comprehensive).

- The Site Gathers Quotes: The comparison site then uses this information to query its network of insurance partners. These partnerships are key – a site can only show you quotes from the insurers it has agreements with.

- Quotes Are Displayed: You’ll see a list of insurance quotes. This usually includes the monthly or annual premium, the coverage limits, and deductibles.

- You Compare and Choose: You can then compare these offers based on price, coverage levels, and the reputation of the insurance company.

It’s important to remember that not all insurance companies participate in every comparison site. This is why using more than one site can be beneficial. Some insurers also prefer direct sales and may not be found on these platforms.

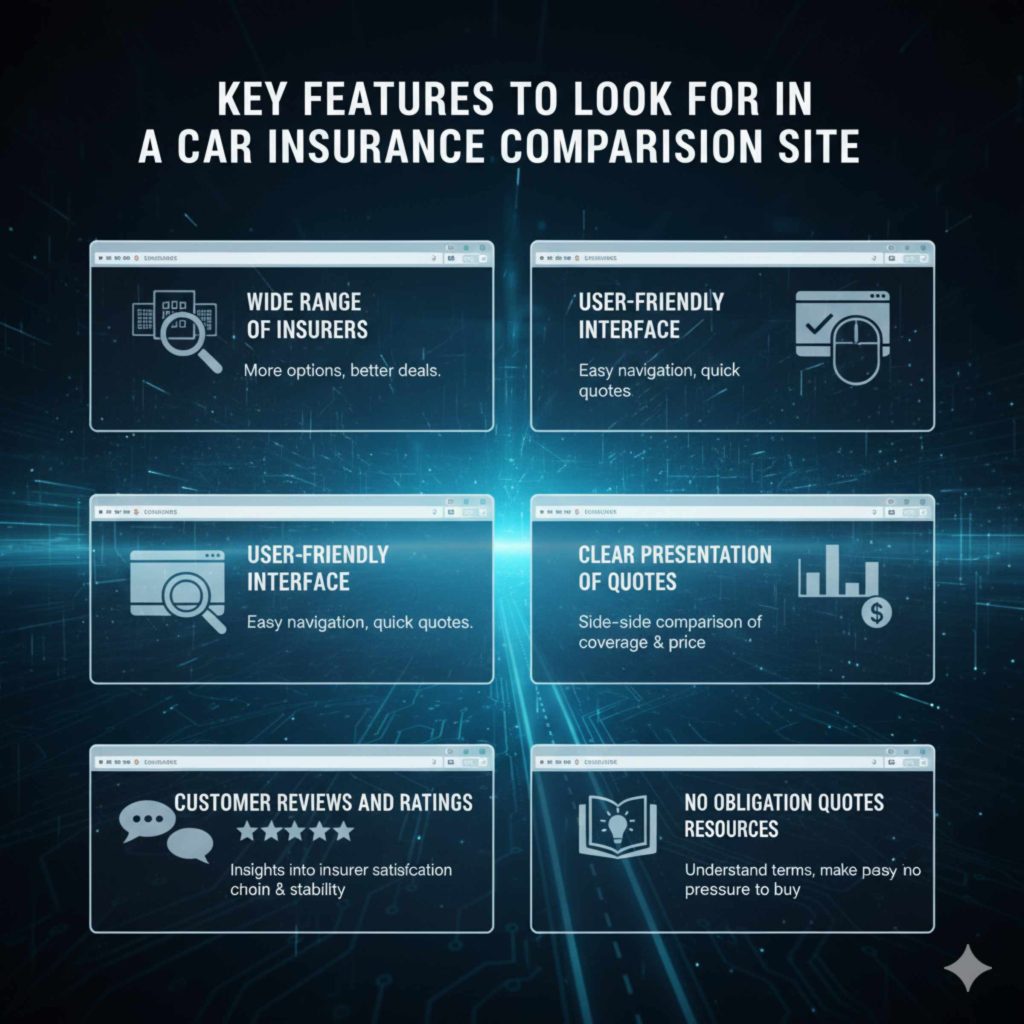

Key Features to Look for in a Comparison Site

With so many options, how do you pick the best comparison site to use? Look for these essential features:

- Wide Range of Insurers: The more insurance companies a site partners with, the better your chances of finding a great deal.

- User-Friendly Interface: The website should be easy to navigate, and the quote process should be straightforward and quick.

- Clear Presentation of Quotes: All quotes should be presented in a way that makes it easy to compare coverage levels, deductibles, and prices.

- Customer Reviews and Ratings: Look for sites that offer insights into the customer satisfaction and financial stability of the insurance companies.

- Educational Resources: Good comparison sites often provide helpful articles, glossaries, and tools to help you understand insurance terms and options.

- No Obligation Quotes: You should be able to see quotes without being pressured to buy immediately.

Top Car Insurance Comparison Sites (Examples)

While there are hundreds, some comparison sites have emerged as popular and reliable choices. Here are a few examples. Keep in mind that the availability and partnerships can vary by state and over time.

It’s always a good idea to check reviews and see which insurers are represented on each platform. This is not an exhaustive list, but a starting point:

Major Comparison Platforms

These sites tend to have broad coverage and partner with a wide array of insurance providers.

- The Zebra: Known for its user-friendly interface and extensive data. They partner with over 200 insurance companies.

- NerdWallet: Offers comprehensive financial advice alongside insurance comparisons. They partner with numerous carriers, providing a good selection of quotes.

- Insurify: Focuses on simplifying the insurance shopping experience with a clean design and a strong network of partners.

- QuoteWizard: Connects users with agents and companies, often providing a slightly more personalized approach.

- ValuePenguin: Offers in-depth analysis and comparisons, backed by data from a variety of insurance providers.

Consider These When Choosing

When you land on a comparison site, take a moment to see:

- Who are they affiliated with? Do they list their insurance partners?

- What information do they require? Does it seem reasonable?

- What do their user reviews say? Look for feedback on their site and the insurers they list.

How Many Sites Should YOU Use?

This is where strategy comes into play. You don’t need to visit all the sites, but using just one might not give you the complete picture. Here’s a recommended approach:

- Start with 2-3 Major Platforms: Pick well-regarded sites like The Zebra, NerdWallet, or Insurify. Input your information to get a broad overview of the market.

- Look for Different Partner Networks: Some sites might have partnerships that others don’t. By using a couple of different major platforms, you increase the chances of seeing quotes from a wider variety of companies.

- Consider Direct Insurers: Don’t forget about insurers that may not be on comparison sites. Companies like GEICO and Progressive, for example, often have strong online presences and may offer exclusive discounts if you get a quote directly from them. You can always visit their websites after you’ve used comparison tools.

- Check for Local or Niche Insurers: Sometimes, regional insurers or those specializing in certain types of vehicles (like classic cars) might offer the best deals, but they might not show up on national comparison sites. A quick search for “car insurance [your state]” can help uncover these.

The goal is to cast a wide enough net to find the best coverage and price without getting lost in an endless sea of options.

What Information You’ll Need to Compare

To get accurate quotes, you’ll want to have this information ready:

- Personal Details: Your driver’s license number, date of birth, and Social Security number (often needed for a hard credit check, but sometimes just for identification).

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), and details about any safety features or anti-theft devices.

- Driving History: Information about yourself and any other drivers in your household, including past accidents, tickets, and claims.

- Current Coverage: If you have insurance now, know your current policy limits and deductibles.

- Mileage: Your estimated annual mileage.

- Location: Your home address and where the car is usually parked.

Having all this at your fingertips will make the quoting process much smoother and faster.

Beyond the Price: Other Factors to Consider

While price is a huge factor, it’s not the only thing to look at. When you compare quotes:

- Coverage Levels: Ensure the coverage limits meet your state’s requirements and your personal needs. Don’t sacrifice adequate protection just to save a few dollars.

- Deductibles: This is the amount you pay out-of-pocket before insurance kicks in. A higher deductible usually means a lower premium, but make sure you can afford the deductible if you need to file a claim.

- Insurance Company Reputation: Check customer satisfaction ratings and reviews. A company with a poor reputation for handling claims can be more trouble than it’s worth, even if the price is low. Websites like Insurance Information Institute (III) offer great resources for understanding insurance topics and company practices.

- Customer Service: How easy is it to reach them with questions or to file a claim?

- Discounts: Ask about available discounts! Many insurers offer savings for things like good grades, safe driving, low mileage, bundling policies (home and auto), or being a member of certain organizations. The U.S. Department of Energy also has tips on saving money that might indirectly relate to your driving habits.

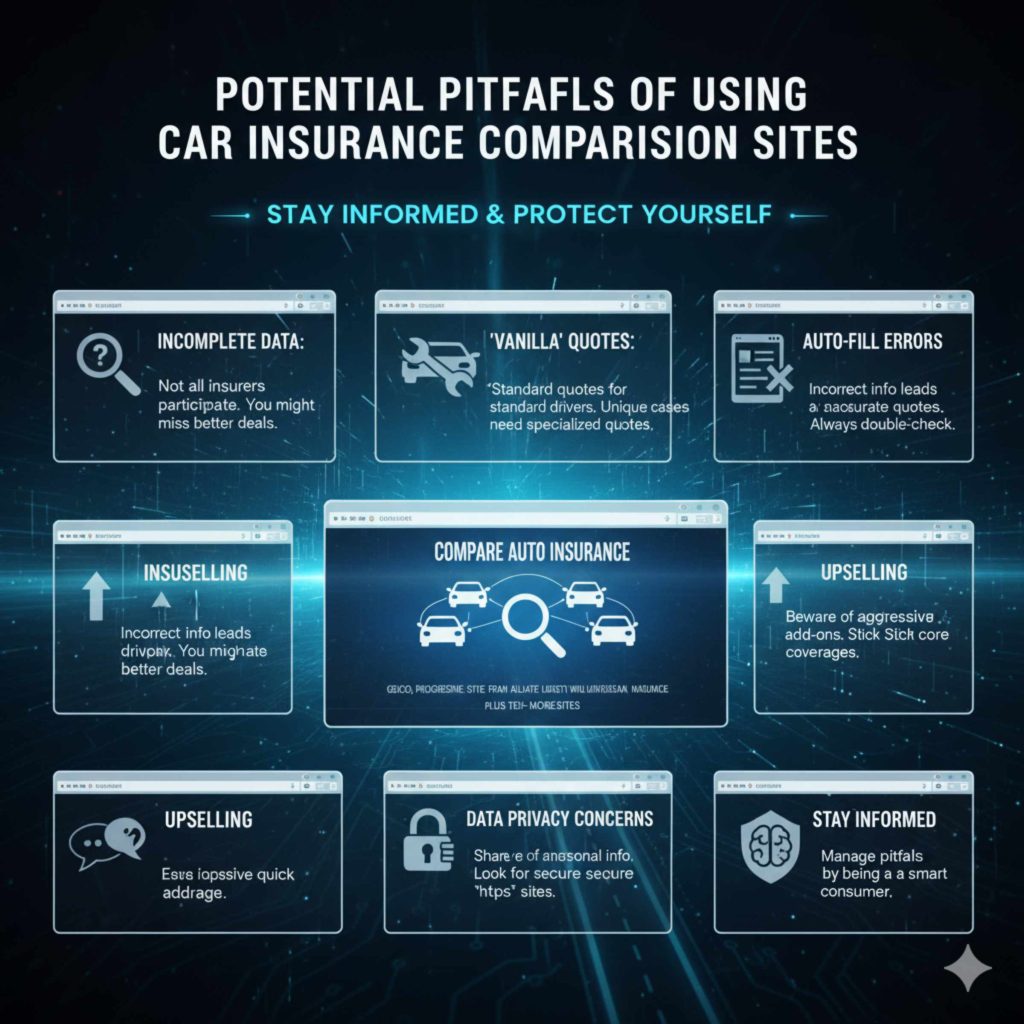

Potential Pitfalls of Using Comparison Sites

While comparison sites are fantastic tools, it’s good to be aware of a few potential downsides:

- Incomplete Data: As mentioned, not all insurance companies participate. You might miss out on better deals if you only rely on one or two sites.

- “Vanilla” Quotes: The quotes you see are often for a standard driver and vehicle. If you have unique circumstances (e.g., a classic car, a very long commute, or a recent accident), you may need specialized quotes.

- Auto-Fill Errors: Sometimes, information can be misread or autofilled incorrectly, leading to inaccurate quotes initially. Always double-check everything.

- Upselling: Be wary of sites that push optional add-ons aggressively. Stick to the core coverages you need and understand.

- Data Privacy Concerns: You are sharing personal information. Ensure the sites you use have clear privacy policies and secure websites (look for “https” in the URL).

These pitfalls are generally manageable by being an informed consumer and cross-referencing information.

Direct Quotes vs. Comparison Sites: A Comparison

Here’s a quick look at the pros and cons of each approach:

| Feature | Comparison Sites | Direct Quotes (Insurer Websites) |

|---|---|---|

| Convenience | High: Input data once, view multiple options. | Lower: Visit each insurer’s site individually. |

| Breadth of Options | Good, but limited to partnered insurers. | Limited to the company you’re visiting. |

| Accuracy of Quotes | Can be less precise without deeper dives; may prompt for more info later. | Often more precise for that specific insurer. |

| Educational Content | Varies; some are very robust. | Focused on their own products, but can be informative. |

| Personalization | Less personal; more automated. | Can sometimes offer more interaction or specialized agents. |

| Potential for Best Price | High, as it shows market averages. | Can be best if you know the insurer offers competitive rates or specific discounts. |

A smart approach often involves using comparison sites to get a baseline and then drilling down with direct quotes from insurers that appear competitive or those you already trust. The Federal Trade Commission (FTC) provides excellent consumer advice on choosing insurance.

Frequently Asked Questions About How Many Car Insurance Sites There Are

Q1: How many car insurance sites are out there?

A: There isn’t a precise count, but there are hundreds of car insurance comparison sites available in the market, ranging from large national platforms to smaller, niche sites.

Q2: Do all insurance companies use comparison sites?

A: No, not all insurance companies partner with every comparison site, and some might not participate at all, preferring to sell directly to consumers.

Q3: Is it better to use one comparison site or many?

A: It’s generally best to use 2-3 reputable comparison sites to get a broader view of available options, as they may partner with different insurance companies.

Q4: Will I get the best price by using a comparison site?

A: Comparison sites are excellent for finding competitive rates, but you might occasionally find even better deals by getting a quote directly from an insurer, especially if they offer unique discounts.

Q5: What information do I need to have ready before I start?

A: You’ll need personal details (driver’s license, DOB), vehicle information (make, model, VIN), driving history (tickets, accidents), and your estimated annual mileage.

Q6: Are there free car insurance comparison sites?

A: Yes, virtually all car insurance comparison sites are free for consumers to use. They typically make money by earning a commission from the insurance companies when a policy is purchased through their platform.

Q7: Can I buy insurance directly from a comparison site?

A: While some sites may facilitate the application process, you usually finalize your purchase directly with the insurance company. The comparison site acts as a referrer.

Conclusion

Navigating the world of car insurance can feel overwhelming with so many choices. By understanding that there are indeed hundreds of car insurance comparison sites out there, you’re already ahead of the game. You don’t need to visit them all; a strategic approach of using 2-3 well-regarded platforms, checking direct quotes from major insurers, and knowing what details to have on hand will empower you to find the best coverage at a fair price.

Remember, comparison sites are powerful tools to help you shop smart. They save you time and can uncover savings you might have missed. So, armed with this knowledge, take a deep breath, gather your information, and start comparing. You’ve got this!